If you take a look at headhunting statistics, more and more banks look like tech companies. Then you can be impressed that 80% of banks

Author: Isec Wealth Management

What to choose to invest in is a challenging question. While some assets like the company’s bonds and equities may seem attractive because of personal

Until recently, Bitcoin has been treated as a completely independent asset due to its unique nature. As a result, there should be no signs of

The asset correlation is one of the measures to which ISEC Wealth Management attributes importance while forming a portfolio. Correlation is a worldwide measure of

The main source of return from stocks coming into mind is dividends. However, dividends being common and iconic, are not the only payout.Shareholder’s returns can

While there was a period when tangible assets like vehicles and plants were the ones driving companies’ growth, the situation has changed significantly with tech

Investors are extremely concerned about the current state of the economy amid soaring inflation, geopolitical instability, expected food deficits in Africa and still present diseases.

The Solow model explains economic growth not only by common factors such as labor and capital but by technological progress, including technology or knowledge, that

The most pronounced idea that instantly comes into mind when speaking about the US monetary policy is quantitative easing (QE). However, the situation has significantly

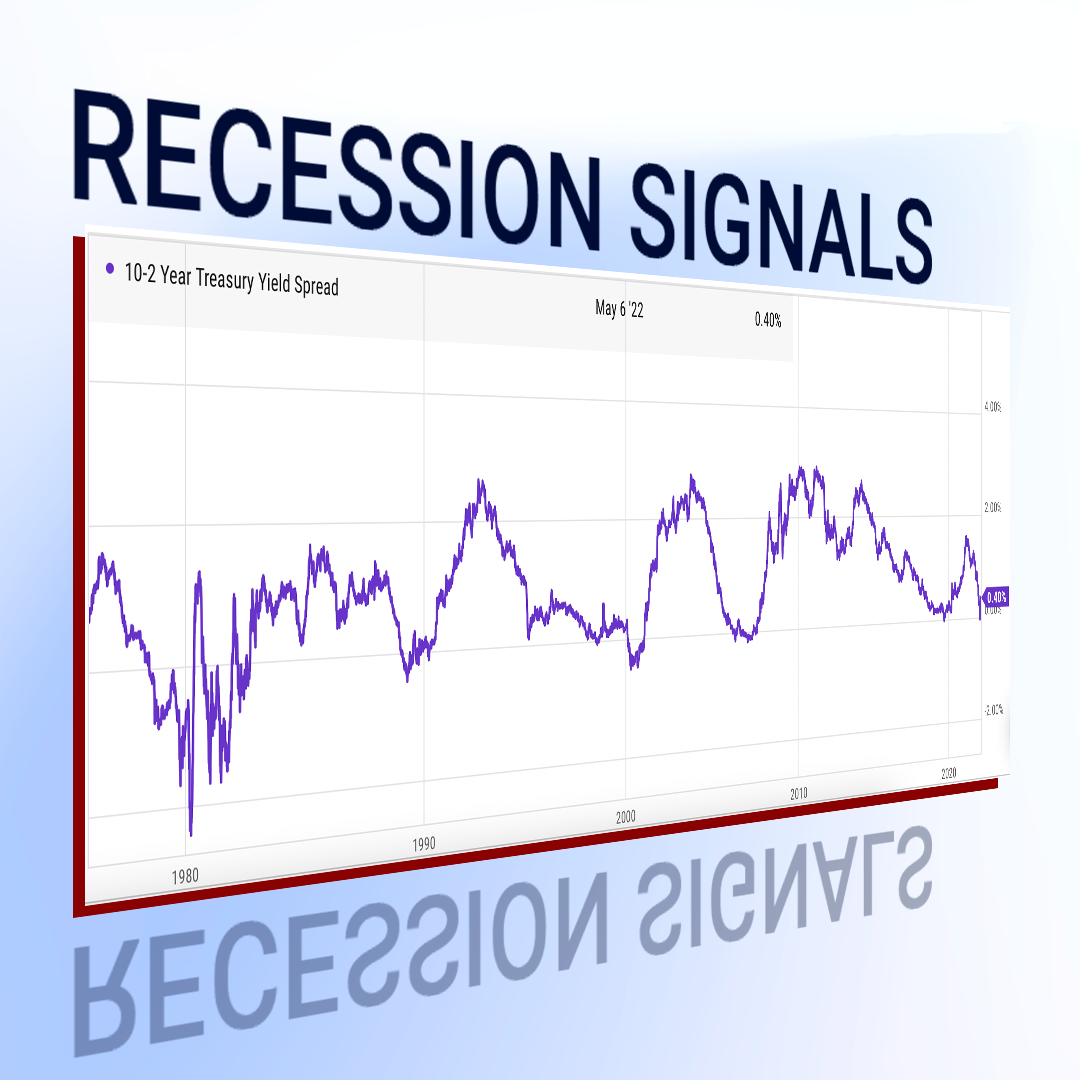

The current state of the economy is turbulent. The fears of recession together with growing inflation are not just in the air but highly evident