The current state of the economy is turbulent. The fears of recession together with growing inflation are not just in the air but highly evident and pronounced.

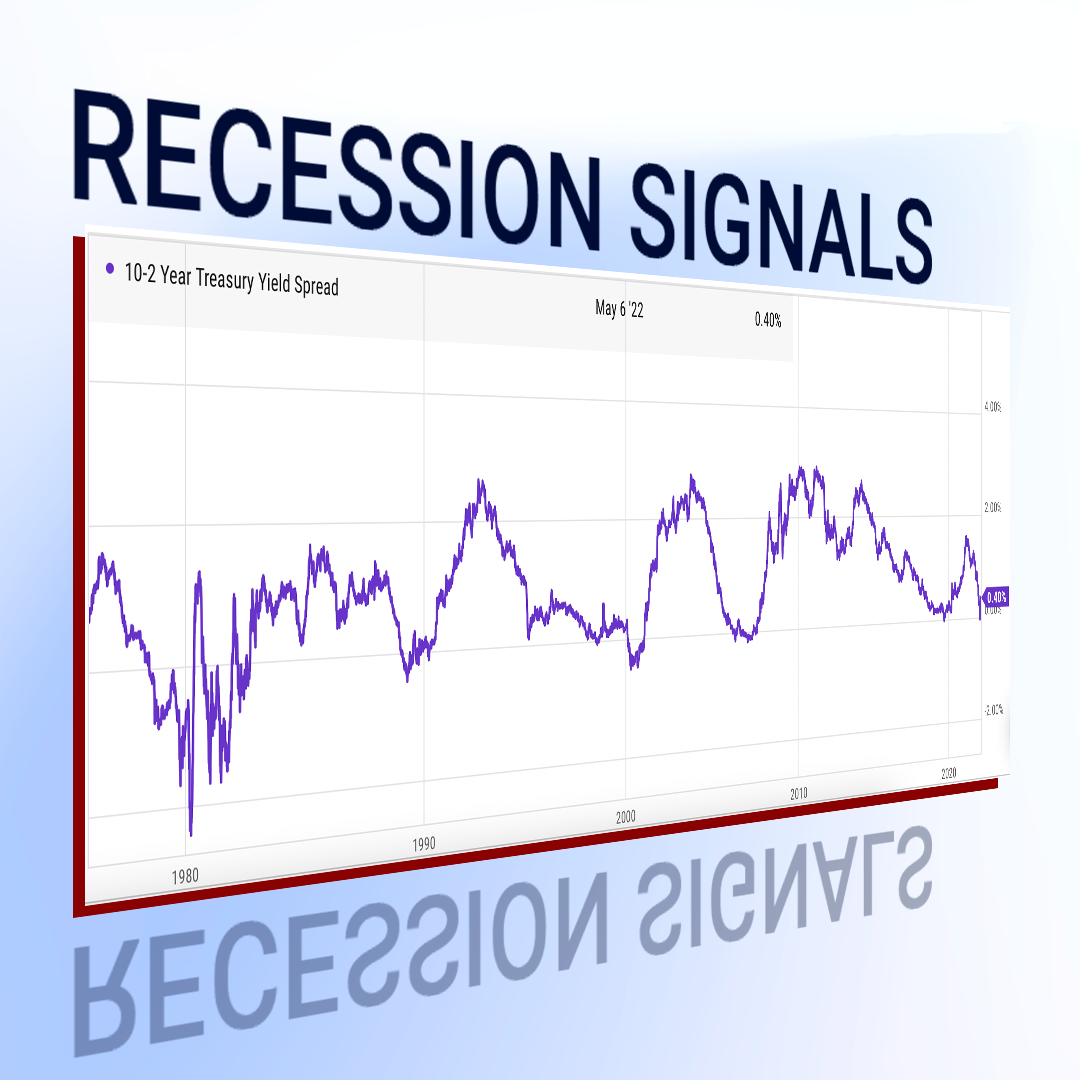

The economy gives strong signals of incoming financial difficulties, and the officials’ actions are turning hawkish. While stocks returned to the green ink phase, the difference between 10- and 2-year Treasury yield spread appeared negative. The negative value of the yields is one of the most reliable precursors of crisis which is to begin within 6-24 months.

For example, the negative spread observed in 2006 was the accurate prediction of the 2008 crisis, and the negative difference in 1998 forecasted the crisis near at hand of the 2000s.

To temper inflation, the Fed is taking active steps of monetary tightening with interest rate increases and halting quantitative easing. The Fed is working hard not to upset the markets and induce a downturn.

In this light, the stocks still remain better protection against inflation as companies’ revenues reflect price rises, and stocks’ returns usually exceed bonds’ ones.

ISEC WM follows all recent market trends and allocated assets in the portfolio accordingly to perform the best.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.