From July 2019 to June 2020, Tesla recorded four consecutive profitable quarters for the first time, which made it eligible for inclusion in the S&P Index. S&P 500 constituent selection is at the discretion of the Index Committee and is based on the eligibility criteria. One of the criteria is that the sum of the most recent four consecutive quarters’ earnings should be positive as should the most recent quarter. However, Tesla wasn’t among the companies to join S&P 500 according to the announcement on September 4. The decision was surprising, and its stock lost over 20% the next trading day. On November 16, 2020, it was announced that Tesla would finally be included in the S&P 500 on December 21, 2020. Following the announcement, the share price went through the roof. As the result, Elon Musk passed Bill Gates to become world’s second richest person.

Inclusion in the S&P 500 means that the funds tracking the index will buy the shares of Tesla, which will likely push the price higher. According to S&P Dow Jones Indices, Tesla will be one of the largest weight additions to the S&P 500 in the last decade and consequently will generate one of the largest funding trades in S&P 500 history (~$51 billion). This is great news for Tesla’s stock price, which is now 36% higher than the day before the announcement. However, there is a catch. Tesla seems to be heavily overpriced. The company has become the world’s most valuable carmaker. Its current market capitalization has exceeded $500 billion, which is higher than Toyota, Volkswagen, Daimler, BMW, and General Motors combined. According to S&P Dow Jones Indices, the price/earnings ratio of the S&P 500 was 34.16 as of September 20. Tesla has reached 1060! This means that during the previous 12 months an average S&P 500 company has generated roughly 3 cents in earnings for 1 dollar of its market capitalization. Tesla has generated just 0.1 cents.

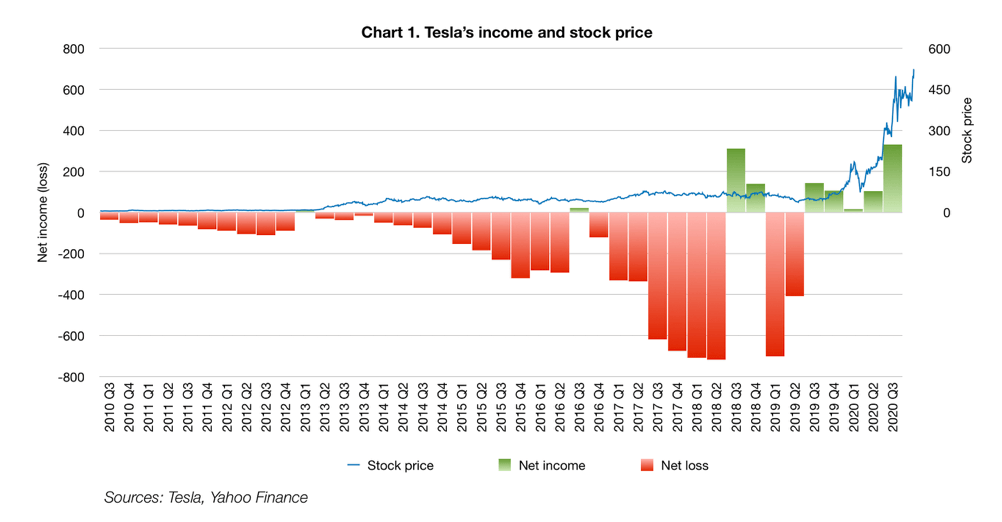

Meanwhile, Tesla reported five consecutive positive quarters: Q3 2019 – Q3 2020 (see Chart 1). It might seem that the company is on a track to achieving sustainable results. But there is an issue with its quality of earnings.

Certain US states like California have laws in place requiring vehicle manufacturers to ensure that a portion of the vehicles delivered for sale in that state during each model year are zero emission vehicles. These laws provide that a manufacturer of zero emission vehicles may earn credits (ZEV credits) and may sell excess credits to other manufacturers who apply such credits to comply with these regulatory requirements. As a manufacturer solely of zero emission vehicles, Tesla earns ZEV credits on vehicles sold in such states and sells them to other vehicle manufacturers. In fact, Tesla’s result is strongly dependent on the emission credits sales. For example, revenue from the sale of regulatory credits totaled, $354 million, $428 million, and $397 million for Q1 2020, Q2 2020, and Q3 2020, respectively. The emission credit sales also helped Tesla achieve its four profitable quarters.

Nevertheless, Tesla as a trendsetter of today’s car industry has undoubtedly a great potential for growth. This stock has been a precious pearl in every investor’s growth portfolio (we described the difference between growth and value investing in our previous post). It will be surely challenging to justify its current valuation over the long term. So while we are looking forward to seeing Tesla’s new fantastic products and innovations, we are also going to keep an eye on its financial statements.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.