Growth and value are two fundamental paradigms, or styles, in stock investing. The battle between growth and value investing has been going on for decades. What is the difference between these two investment strategies and which one works best?

World’s top proponents of value investing like Warren Buffett have contended that the core of value investing is investing in bargain-priced securities or assets. That means purchasing assets for less than they are worth. Value investing is a strategy that involves the purchase of securities that appear to be undervalued based on fundamental analysis. These stocks trade at discounts to book value, have high dividend yields, low price-to-earning or low price-to-book ratios.

Growth investing focuses on capital appreciation. When investors purchase growth stocks, they expect to earn money through capital gains when they eventually sell them. Growth stocks are considered the stocks that may outperform the overall market over time because of their future potential. Those who follow this style, invest in growth stocks, even if they appear overvalued in terms of metrics such as price-to-earnings or price-to-book ratios. These shares usually do not generate dividends, because companies reinvest their profits to speed up growth.

Growth investing and value investing are generally considered opposite. However, as Warren Buffett wrote to the shareholders of Berkshire Hathaway, “two approaches are joined at the hip: growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive”.

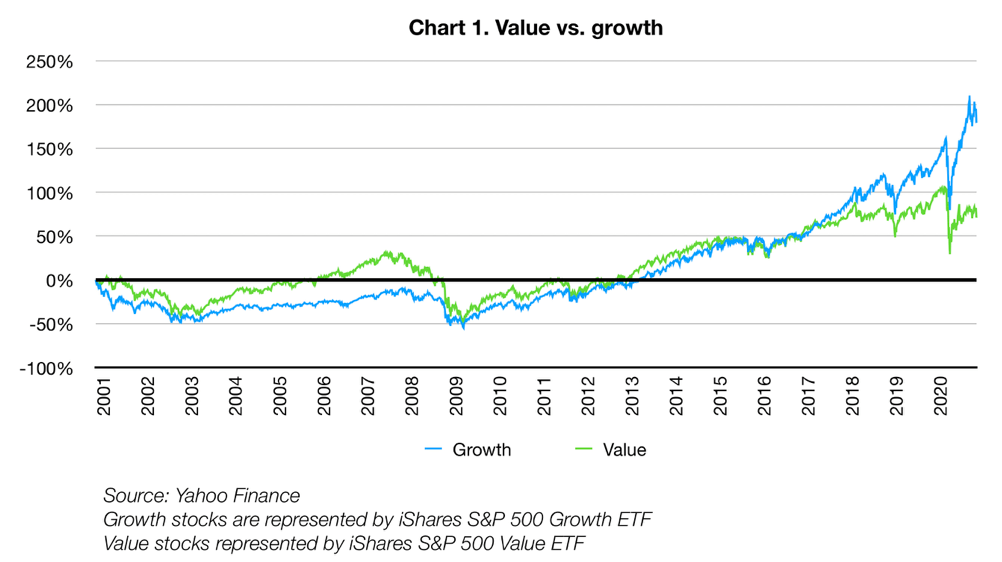

Which of the two approaches is the best? One interesting finding is that the performance of the value strategy is more volatile. Nevertheless, value historically outperformed growth. Across all one-year periods from 1926 to 2007, value demonstrated higher performance in almost ⅔ of the time. With long-term investment, the advantage of value investing was even higher: across all five-year periods, value outperformed growth in over 80% of the time. However, the situation has changed after the financial crisis of 2007-2008 (see Chart 1).

Growth has generally outperformed value since 2008. Macroeconomic trends currently favor growth investing. Low-interest rates give growth companies easy access to cheap capital, which is great support for a fast-growing business. On the other hand, the low-interest environment impacts financial corporations, which are strongly represented in value portfolios. The performance of the growth strategy is also supported by the rapid growth of tech companies, which are usually the major component of a growth portfolio. This is especially true during the COVID-19 crisis, which favors the tech sector, as more people and businesses have been pushed online. Nevertheless, nothing lasts forever. There will undoubtedly be times when value outperforms growth and vice versa. The answer to the question of what strategy is most appropriate depends on the investor’s objectives, risk tolerance, time horizon and market conditions. On top of that, it’s always a good idea to seek professional advice.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

Once again I was convinced that cooperation with ISEC WM is also about acquiring new knowledge. Since becoming a client of this company I have become interested in the stock market and read many articles like this one.

For some people this info might seem simple enough i guess, but I think starting with basics and explaining it from a to z is exactly what most starters like me need.

Thanks for the article, I too began to get involved in investing, having invested in a portfolio led by ISEC WM.

Indeed, stocks can be roughly divided into two types. The first are stocks of companies, such as Netflix, whose value shows a long-term upward trend. Such companies pay virtually no dividends and channel their profits into company growth. These stocks can be called growth stocks.

Other companies, on the other hand, maybe unfairly undervalued, for example, as a result of a boardroom scandal that has occurred, while the companies themselves have strong positions. You can buy them cheap and get good dividends. ISEC WM is well versed in these matters and will help you find a good portfolio.