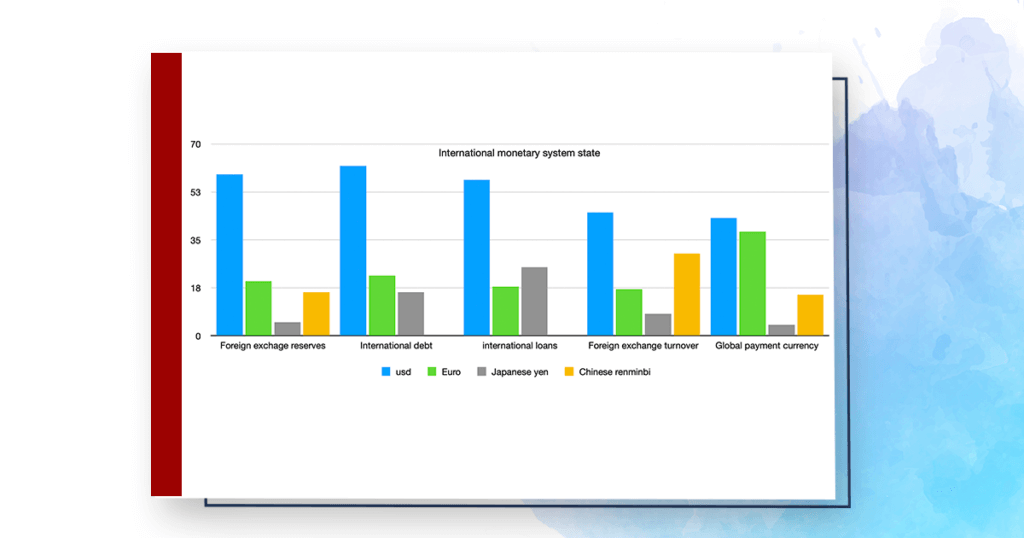

Currently, the role of the US dollar is ubiquitous. The dollar’s share in foreign exchange reserves is about 60%, and more than 60% of international debt is denominated in greenbacks. Moreover, the dollar’s share of international loans is about 55%, 45% of foreign exchange turnover, and 45% of global payments are made in dollars, too. The euro takes the 2nd place in all estimates and is followed by the yuan (taking the 3rd place) with a room to catch up.

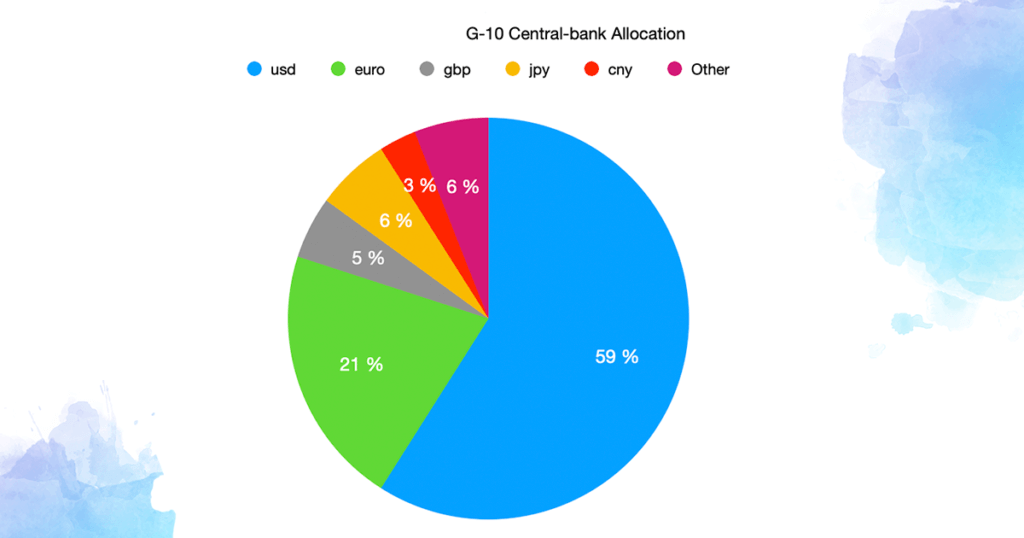

Looking at the data above, it seems complicated to think about any de-dollarization to come. However, the signs of de-dollarization can be observed in the market. The dollar is still the leader in reserves allocations, but the gap between the dollar and other currencies is narrowing. Looking at G-10 allocations, we can notice that the dollar’s share shrank from 70% in 2001 to 59% in 2021.

The US dollar has seen unprecedented dominance being «world» everything: the reserve currency, store of value, means of exchange, and unit of account in the world after the Bretton Woods conference. However, amid regionalization of currencies caused the dollar to lose the yuan in particular markets. The US is no longer the world’s largest trading country, giving way to China.

The situation of de-dollarization can be fostered by the countries’ reluctance to absorb the US inflation, so governments may reconsider dollar trades when possible. Besides, some countries take steps to de-dollarize their economies to demonstrate their concerns about the US dollar’s worldwide hegemony.

It is evident that the US dollar will not end up at once, but the structural changes are interesting to keep in mind and should be considered while planning long-term investments. That’s ISEC WM follows the possible global trends, even those not impacting the economy the current day, week, or month as they might do in the future.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

The basic premise is absolutely true, given how the greenback lost its value over the past century. But the end result won’t come overnight, because the US inflation is relatively okay compared to what is going on across Europe. At this point in time, USD is king. This might change overtime, but not soon.