Junk bonds are speculative-grade bonds or high-yield bonds paying extra for the excessive risk of default on payment. While some investors shy away from these riskier assets, some view them as a boosting returns allocation.

Junk bonds’ risk-return correlation is greater to stocks’ performance rather than investment-grade bonds. To compare, within 30 year period, US high-yield bonds have had a 0.22 correlation to a broad range of investment-grade bonds, 0.61 to the S&P 500 Index, and almost the same 0.60 to global stocks measured by the MSCI World Index. Junk bonds have nearly matched stock performance but with lower volatility.

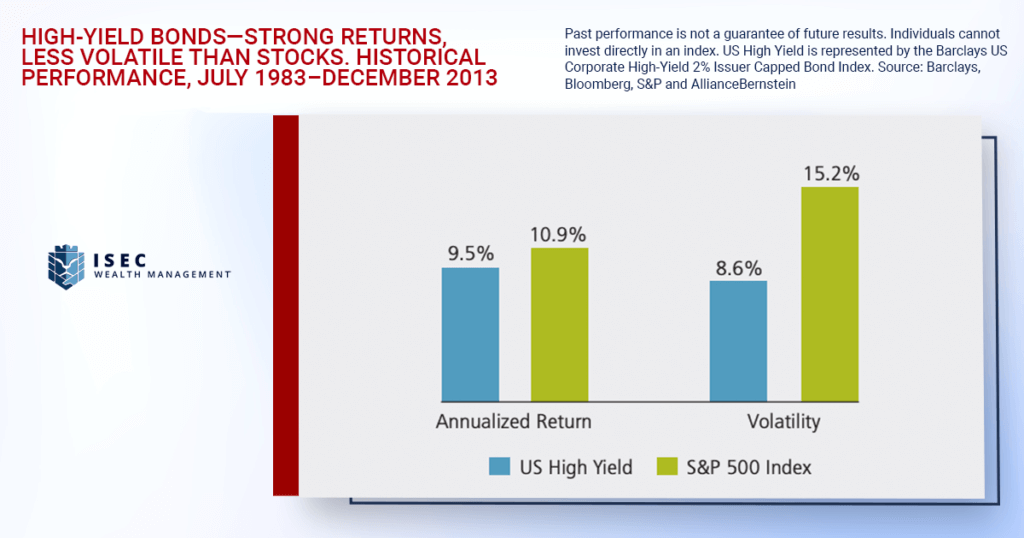

It can be explained by the fact that junk bonds are still fixed-income assets, bearing lower risk than stocks, and are subject to prior compensation in case of a company’s default. For example, the annualized volatility of US high yield bonds is 8.6%, while for S&P 500 Index it is 15.2%, and annualized return is 9.5% and 10.9%, respectively.

Thus, high yield bonds can be a good way out for investors willing to temper risks without sacrificing much of their income. As stocks are more volatile and have performance extremes, called the «tails» in return distribution, it is necessary to pay attention to portfolio rebalancing. Adding high yield bonds to an investor’s portfolio can mitigate volatility from 15.2% to 10.7%, as shown in the example above.

Besides, the occurrence of a company’s default is quite low. 2021, though quite unstable amid the pandemic, has demonstrated a high yield default rate at a record low of 0.5%. Fitch forecasts 1% default for 2022 and about 1%-1.5% in 2023.

Sources: alliancebernstein.com, fitchratings.com

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.