Banks, investors, and officials have already resigned their minds to the upcoming, even several, rate rises. Many experts agreed on four rate rises, while some predicted even 6 or 7 ups. 10-year Treasury Yield is growing, getting closer to 3% on the April 2022, and it looks like to keep going up further.

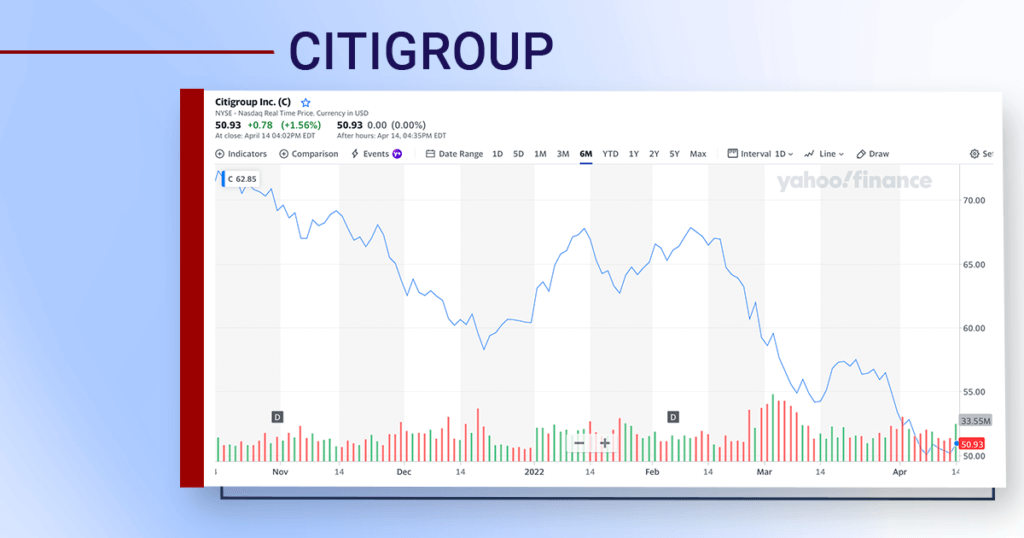

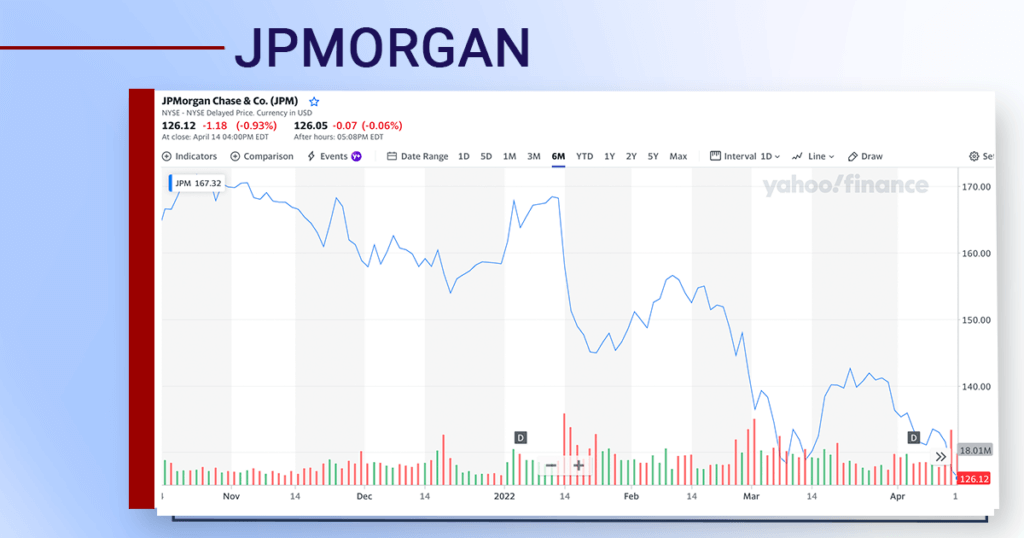

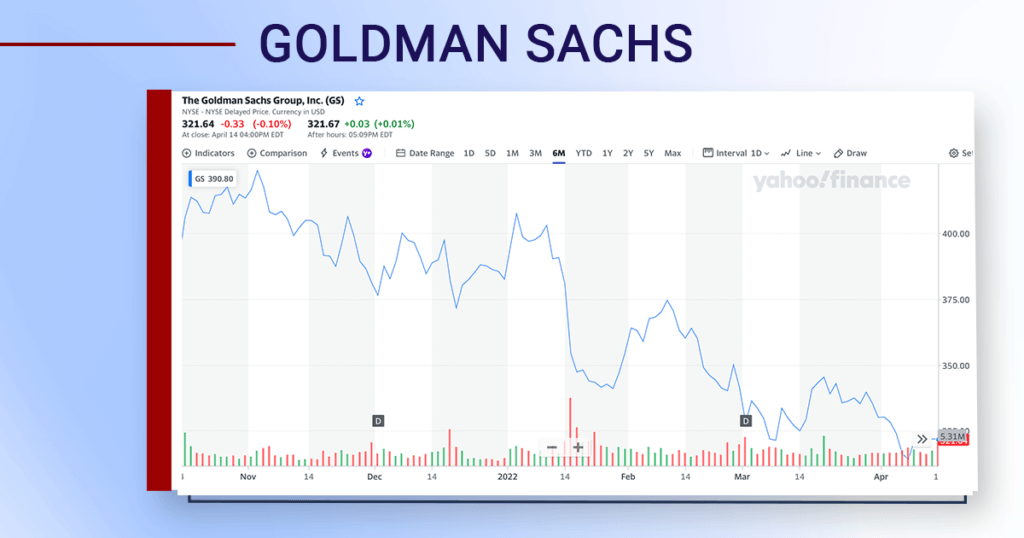

At first, the banks are expected to benefit from rate increase as the higher the interest rate is, the greater the gap between lend and deposit rates may be. However, it does not work this way. Share price movements support it. Citigroup, JPMorgan, Goldman Sachs, and other major bank shares demonstrate a downward trend within at least 6 months.

Several reasons suit to explain this share price decline.

1. Banks’ asset-liquidity management is complex and sophisticated, so the duration of deposits and credits does not match so perfectly, imposing constraints on banks’ financial stability and soundness. Long-term cheap credit may be financed by expensive short-term deposits.

2. Together with liquidity losses, banks’ shares decline is provoked amid the anticipation of trading and corporate finance contraction as the inflow of cheap money is no longer available to finance company’s activities. According to the first quarter of 2022, Citigroup’s revenue went down 2% to $19.2. Revenue from trading and investment banking declined by 2% to $11.16. Goldman Sachs has also reported a decline in trading activities and a slowdown in mergers, IPOs, and debt issuance. Goldman Sachs investment banking revenue dropped 36% to $2.41 billion.

3. The potential rate gap widening is demolished by the increasing bank compensation costs. The salary increase was fostered by the growing demand for financial services together with soaring inflation and a competitive labor market. All top banks seek top talents and reward them generously, especially in finance and engineering.

Banks’ unprecedented profitability based on the state stimulus has returned to its normal levels marking the necessity to come back to competitive reality and find new ways out.

Sources: wsr-j.org, economist.com, cnbc.com(citigroup-c-earnings), cnbc.com(gs-earnings)

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

They are right about many points there. The whole blog is quite influential and beneficial on financial education. I will stay tuned and keep catching up with the updates and more blog posts.