Markets have recently seen spouts of exuberance (some of which we have covered on our blog, here, here and here). Among the craze ranging from crypto currencies to NFTs, a new type of stock was born knows as “meme stocks”, or simply “stonks”. Meme stocks are stocks promoted by “retail investors” * on social networks such as Reddit. These stocks go viral through these online boards and increased attention by news outlets. The excessive increase in a meme stock’s trading volume is not driven by the company’s performance, but rather by the hype gathered on these boards. Thanks to the hype, these stocks often experience sudden and dramatic price increases, regardless of the underlying fundamentals of the company, even if the company has declared bankruptcy (see here). Due to the artificial increase in price, which has nothing to do with the firm’s actual performance or its growth potential, the subsequent drop in price can be even more spectacular that its rise.

The idea behind meme stocks was that institutional investors were shorting some stocks and then spreading negative rumours to depress the stock price (short sellers benefit when the price of the asset falls). Retail investors decided they had enough of this and decided to fight back against these institutional investors. Their main targets were companies that had a high short interest, meaning the number of shorted shares as a ratio of total shares outstanding. After finding a target, retail investors would try to gather fellow retail investors through these boards and attack their target using a delta squeeze strategy.

When traders buy call options, market makers have to buy shares to hedge (also known as delta hedging). As more and more people started buying call options on companies like Gamestop and AMC Entertainment, market makers had to buy shares to hedge their positions, which in turn pushed prices higher. When prices went higher, short sellers had to cover their positions (short sellers borrow shares which they then sell in the market; if the price drops they buy at the lower prices and deliver the shares to the lender for a profit, if the price increases they buy at the higher prices and deliver the shares to the lender for a loss) by buying shares which sent prices even higher.

Retail investors found a way to use their small accounts to push institutional investors to the brink of bankruptcy, and it actually worked to a certain extent. Although one of the criteria is a high short interest ratio, not all high short interest companies became meme stocks. Retail investors targeted companies for which they have a sense of nostalgia or emotional attachment to. This mix provided them with enough fuel to punish the hedge funds that had bet massively against them.

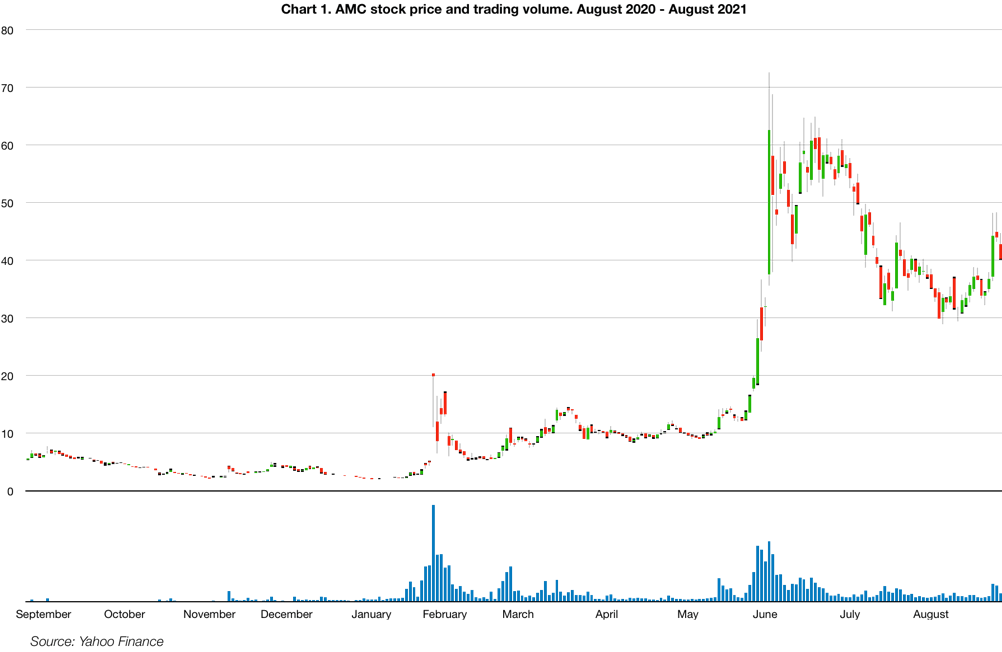

GameStop, AMC, and BlackBerry are the most prominent examples of meme stocks. On Chart 1, you can see the price and trading volume of AMC stock for the past 12 months. The movie theater chain’s business has been severely damaged by the COVID-19 pandemic, its earnings are poor, and the company is massively indebted, which explain the depressed stock price and high short interest. You can see the sharp and significant surge in volume prior to the share price jumping significantly. As any smart manager would do, AMC management decided to issue new shares at these elevated price levels (usually has a negative impact on price, but this was taken as a positive by market participants). AMC even warned prospective buyers of its new stock offering about the risks: “The market prices and trading volume of our shares of Class A common stock have recently experienced, and may continue to experience, extreme volatility, which could cause purchasers of our Class A common stock to incur substantial losses” and yet investors gobbled up the newly issued shares.

A meme stock’s price isn’t justified by the fundamentals, therefore purchasing them cannot be considered a serious investment. Instead, it is a fun and speculative play similar to going to a casino and throwing all your money on red i.e. very risky. A lot of retail investors made significant profits, however even more investors lost part or all of their savings as they were left holding the bags. Investors should carefully consider the risks involved in the purchase of such stocks. * There has been a rise of bots that post on some of the popular boards, resulting in the stock price pumping while the actors behind the bots dump their stocks at the elevated levels.

Outside investors see this trend and jump on to the bandwagon thinking that it would be a get rich quick scheme or as a once-in-a-lifetime opportunity. However, when events like this occur, usually the price spike is short-lived, as the higher prices elicit short sellers to sell at these unsustainably higher prices and profit from the subsequent drop in price; thus, the disparity between the market price and the true value tends to correct itself in the medium to long run. And so, the fun ends… until the next meme stock appears.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

Very interesting article, about Meme stocks, indeed, these are very risky instruments that soar in price very quickly, but often turn out to be bloated like bubbles.

I prefer a more relaxed classical approach to investing. For example,investing with ISEC WM and leaving it to real pros 😉

To be honest, I didn’t quite understand some things from this article, but it was very interesting to read.

In fact, after I became an ISEC WM client, I started reading more information like this.