Another interesting trend among the recent phenomena is the skyrocketing of SPACs. As with the other recent frenzies, the reasons are zero interest rates, boredom during working from home, FOMO, economic stimuli (it is really astonishing how the stimulus money is spent!). SPAC stands for special purpose acquisition company. A SPAC is a company without any operations and is created solely to raise capital through an IPO and acquire a private company, thus making it public without going through the traditional IPO process.

A SPAC is a shell corporation when it becomes public. It has no underlying operating activity and has no assets other than cash and limited investments, including the funds raised through its IPO. The proceeds from the SPAC IPO (less money used for certain fees and expenses) are usually held in a trust account. These funds may only be disbursed to complete an acquisition or to return the money to investors. At the time of its IPO, a SPAC often doesn’t have any identified acquisition target. A SPAC generally has two years to conclude a transaction or face liquidation.

After an acquisition target is identified, each SPAC shareholder can either remain a shareholder of the company after the transaction or redeem and receive a respective pro rata amount of the funds held in the trust account. If the SPAC does not complete a business combination, the shareholders are the beneficiaries of the trust and entitled to their pro rata share of the aggregate amount held in the trust account. If the SPAC shares are purchased on the open market, the investor is only entitled to the pro rata share of the trust account and not the price at which the SPAC shares were bought on the market.

SPACs have become a popular instrument for making private companies public. A merger with or acquisition by a SPAC is often considered a method for a private company to become publicly traded, which is easier, faster, and more predictable as compared to traditional IPOs.

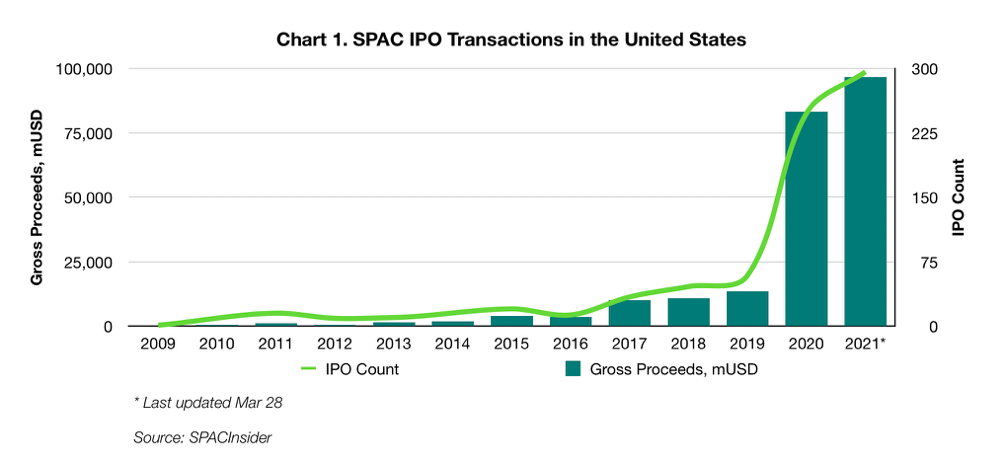

However, there is a serious problem with respect to the investing in SPACs. It stems from the insane growth in their number and the volume of funds raised (Chart 1).

You can see that the capital raised by SPACs exploded in 2020. It doesn’t seem to be slowing down in 2021. Currently, SPACs represent about 70% of the U.S. IPO market. The SEC emphasizes that with an increasing number of SPACs seeking to acquire operating businesses, it is important to consider whether attractive initial business combinations will become scarcer. With growing supply of capital, the valuations are expected to become more detached from the reality and less attractive for the investors. In fact, that sector may well be viewed as being in a bubble. The craze is supported by some celebrities, from movie stars to professional athletes, who promote SPACs or even formed their own ones. SEC even warned investors about buying SPACs endorsed by celebrities. As a SPAC has a limited lifespan, the sponsors are motivated to close whatever deal before the time runs out. This means that the business it is going to make public is not necessarily a good investment. Investing in a SPAC is buying a pig in a poke. In our view, a well diversified and professionally managed portfolio of operating companies’ stocks is a better option for any investor.

Disclaimer: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Investing in financial instruments involves a high degree of risk and may not be suitable to all investor. Please refer to the Risk Disclosures in our web site for further information.