In the world of wealth management, staying updated with the economic trends is a constant necessity.

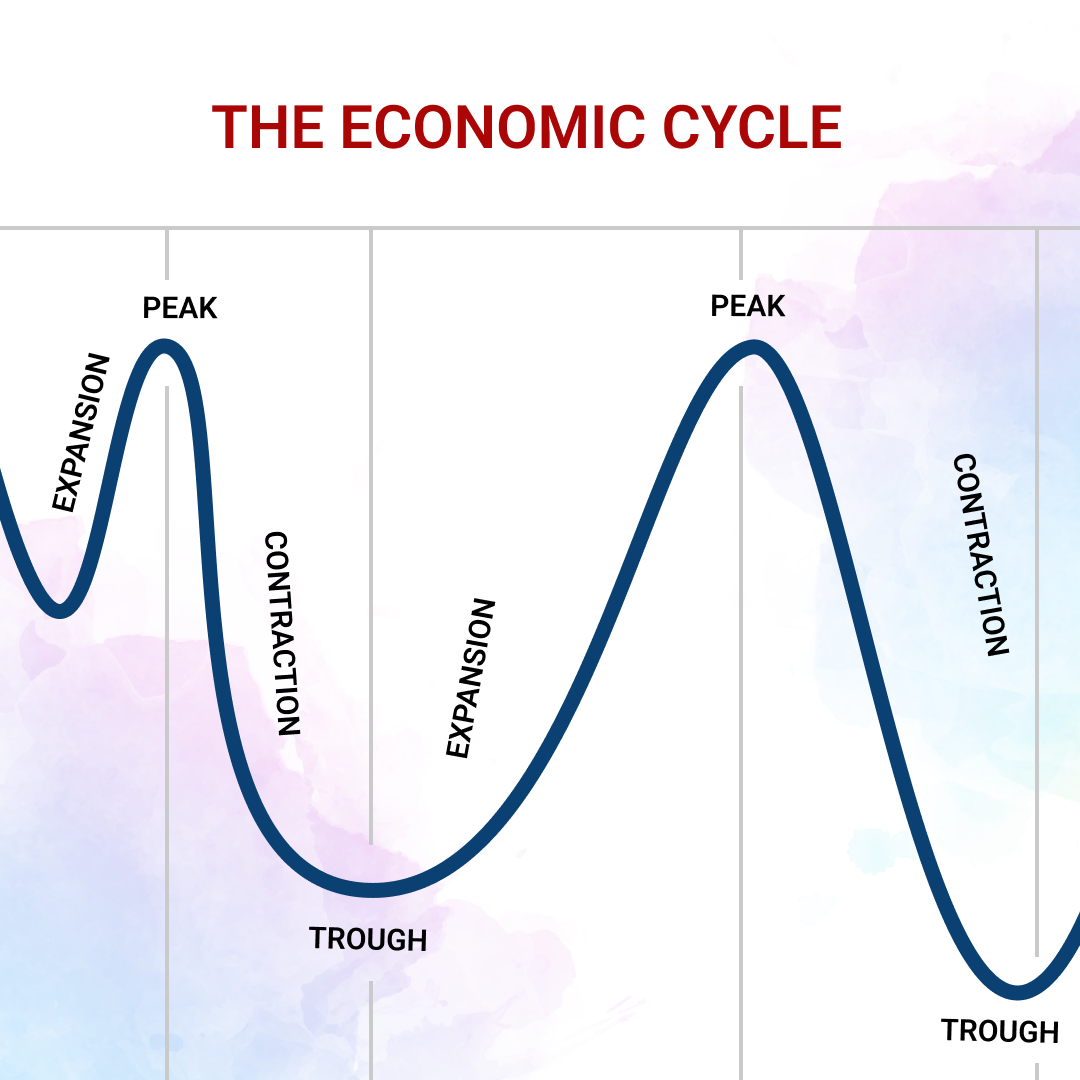

Economic cycles and trends are not predictable with 100% certainty. However, understanding their historical patterns (Expansion, Peak, Contraction, Trough) is crucial for the potential impact on investments. So that wealth managers can make knowledgeable decisions that benefit their clients.

As an example, during the recession, the stock market and its derivatives are susceptible to bullish tendencies. Therefore, the wealth management portfolio should be rebalanced intelligently. Sometimes, it is necessary to expose the portfolio to more fixed-income securities to provide maximum preservation of the capital.

Investors, in their turn, should actively engage with their wealth managers, keeping them fully cognizant of their financial goals, risk tolerance, and time horizons. By doing so, create wealth management strategies that can navigate successfully through the ever-changing economic landscape and help individual investors and legal entities in achieving their financial objectives.

Ultimately, knowledge of economic trends is a valuable tool in the arsenal of any wealth management entity striving to secure and grow their clients’ wealth.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

This is something that looks easy in theory but is quite hard to implement in practice.

Identifying trends, what stage of the cycle the price is, and what to do at a certain point demonstrates a lot of experience and knowledge.

I am interested in learning, but when it comes to making investment decisions, I trust the experts at Isec WM.

Amen brother! Investing and all the economics indicators and reports are too complicated for me and my average mind%-)