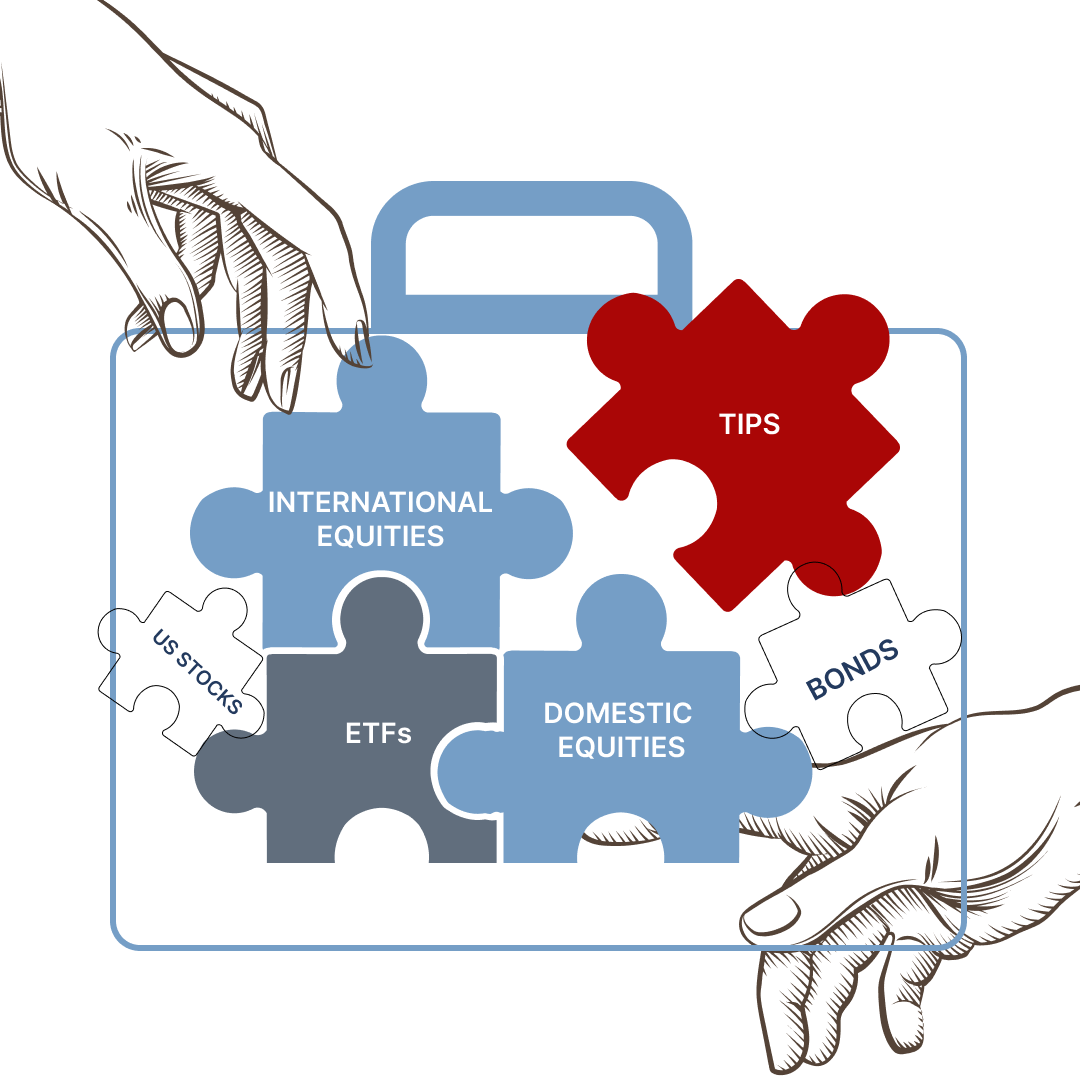

Diversifying a wealth management portfolio requires a certain level of prowess from the portfolio manager. The main goal is to balance out the yield of the given portfolio and the exposure to risks.

Equities are a noticeable part of this diversification. There are two major camps of equities: domestic and international.

While international securities may seem at the forefront of the investing industry compared to its counterpart, it’s not as straightforward.

International stocks can give extra appreciation over the course of time to the portfolio. But this is correlated with some risks.

For instance, international equities can be susceptible to the price fluctuations of exchange rates of currencies.

Some international shares bear the risks of an unstable economy and political or geopolitical uncertainties. The lack of information about the companies issuing the equities must also be considered as a potential jeopardy.

Sometimes, international securities have lower liquidity compared to domestic ones. Since on some markets, stocks are traded with less regularity.

All these conditions must be taken into consideration while creating or rebalancing the ISEC wealth management portfolio.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

Some good points in this article. 👍

I never thought about diversification in this aspect, dividing the equities in domestic and international, and it makes perfect sense…

How effective is portfolio rebalancing? Do I need to be involved in the process?

Rebalancing is very effective, otherwise it wouldn’t be mandatory for any portfolios.

And no, you are not involved in the process, just because you are not competent enough to do so.