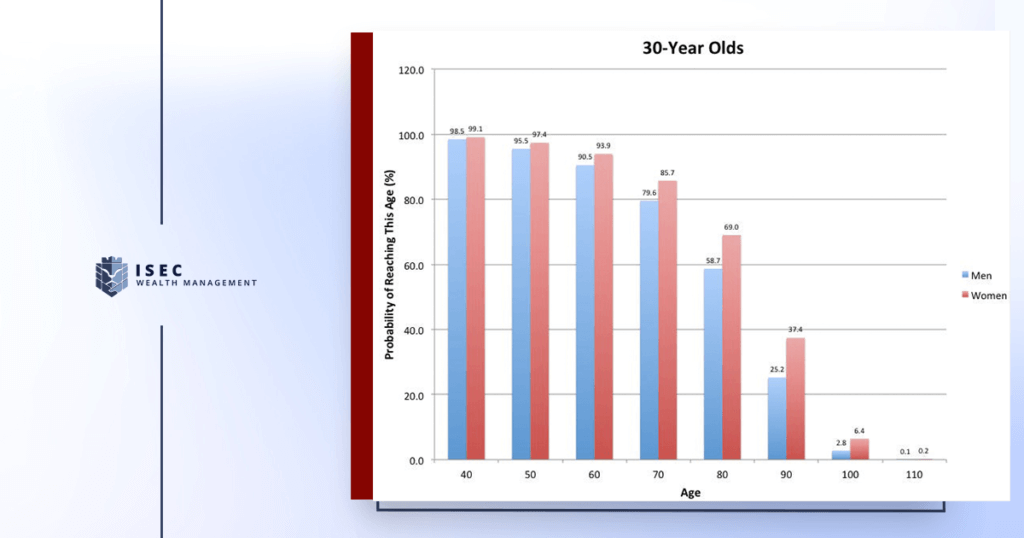

By 2050, 16% of the global population will be above 65 years old. Compare it with 1990 with its 9% to get the feel of dynamics. Over 80% of both genders that are in their 30’s now are likely to celebrate their 70th birthday.

At the same time, only 24.8% of people worldwide save for old age. This lack of savings, together with population aging, creates significant liabilities on pension systems, resulting in the risk of many pensioners have low financial resources to support them during retirement.

Many retirement experts claim that at least 70 percent of preretirement income is necessary to maintain one’s standard of living. It’s worth pointing out that while the 70 percent replacement rate is the most often cited goal, there are other retirement advisers and experts who think it should be much higher, at about 100 percent.

The earlier you start, the better when it comes to planning retirement. Depending on the type of assets a person is willing to invest, benefits vary. While the common knowledge is that bonds are safer assets in the long term perspective, statistically, it is more profitable to invest in stocks. Over the investment horizon, longer than 10 years, stocks have historically outperformed other securities such as bonds. The former gives higher returns with decreasing risks over time. However, your investment strategy can change over time. Rebalancing the portfolio with higher allocation in less risky securities is all that it takes. As you get closer to the retirement age, reducing the stock ownership gradually to avoid losses can be adviced.

Sources: un.org, businessinsider.com

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

That is why we should make an investments now and don’t wait till it is late. Good thing is that ISEC WM provides such possibility for different needs.