One more way of diversification is to invest in financial instruments of international markets. While the financial instruments remain the same, like stocks, bonds and

Launching a new business may seem attractive and romantic, but it is necessary to think it through. Statistics give the facts worth thinking about. So,

Market-neutral strategies are an inherent part of investment strategies. The main feature of a market-neutral portfolio is that it is created in the way the

Portfolio management is a complicated and challenging activity demanding a professional understanding of the financial market. Referring to an asset manager for professional and high-quality

High-frequency trading (HFT) can be used to achieve profitable performance. It is used to execute a significant number of orders within a short period. Advanced

The increase in numbers of liquid alternative mutual funds has provoked additional interest in their returns, risk, and diversification strategy compared to hedge funds. Liquid

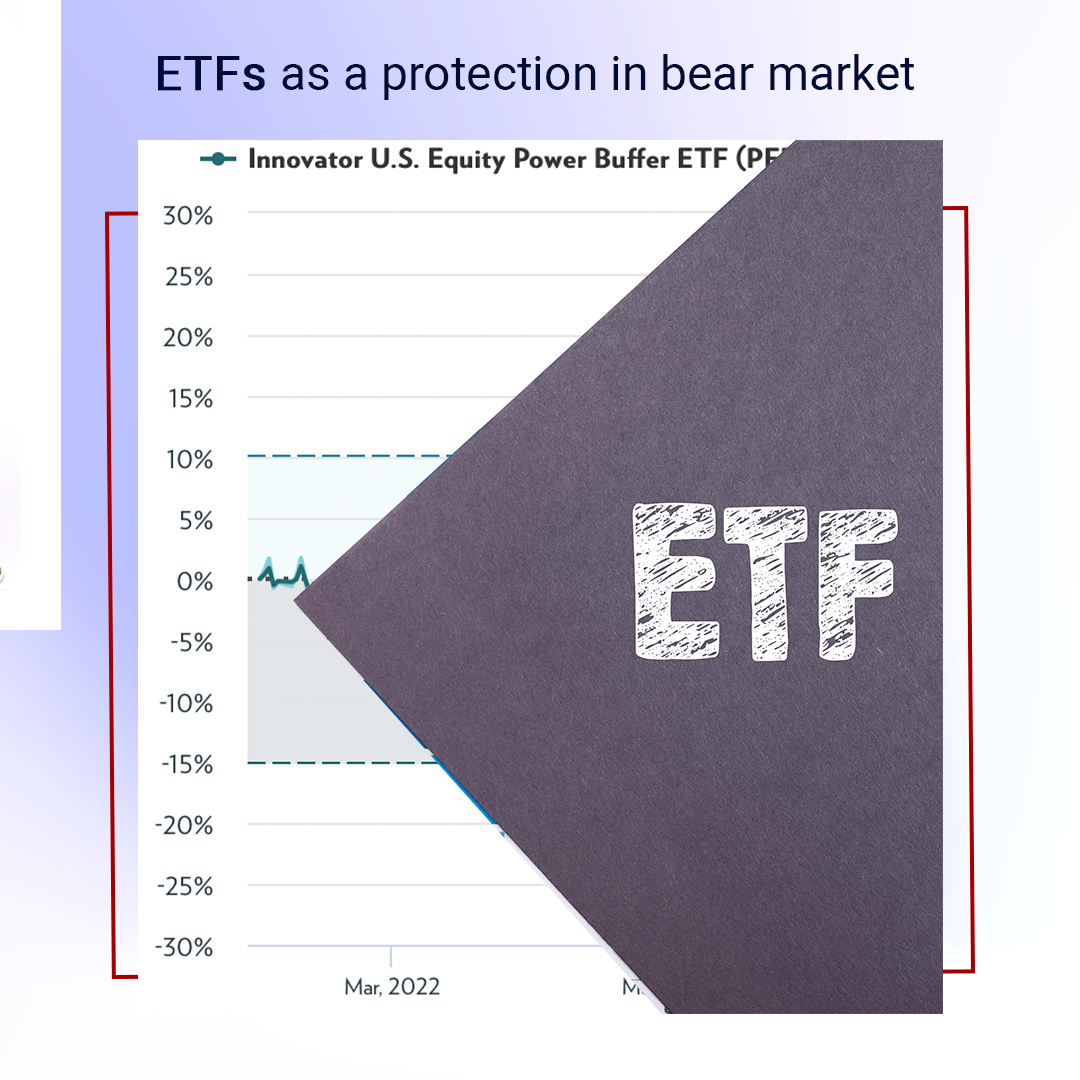

Defined-results ETFs or buffered ETFs are created for those who are worried about a bearish market and do not mind limiting gains in return for

The accurate prediction of stock prices is one of the keys to successful trading. With the advances in computational technology, the implemented Machine Learning (ML)

The application of Artificial Intelligence in trading has accelerated in recent times. While computational methods were first used for testing trading strategies and creating trading

The times of low interest rates in the USA have passed. Still, the habit of affordable debt financing is strong for both banks and companies.