The times of low interest rates in the USA have passed. Still, the habit of affordable debt financing is strong for both banks and companies. Although the market size of debt financing has shrunk by 75% compared to the last year, the potential losses of banks and companies still seem impressive.

With such impetuous rate rises, banks that have turned up the thumbs on bond issuing will face losses amid interest rate differences. Among them are Bank of America, Credit Suisse, and Goldman Sachs have agreed to finance a $15 billion Citrix deal.

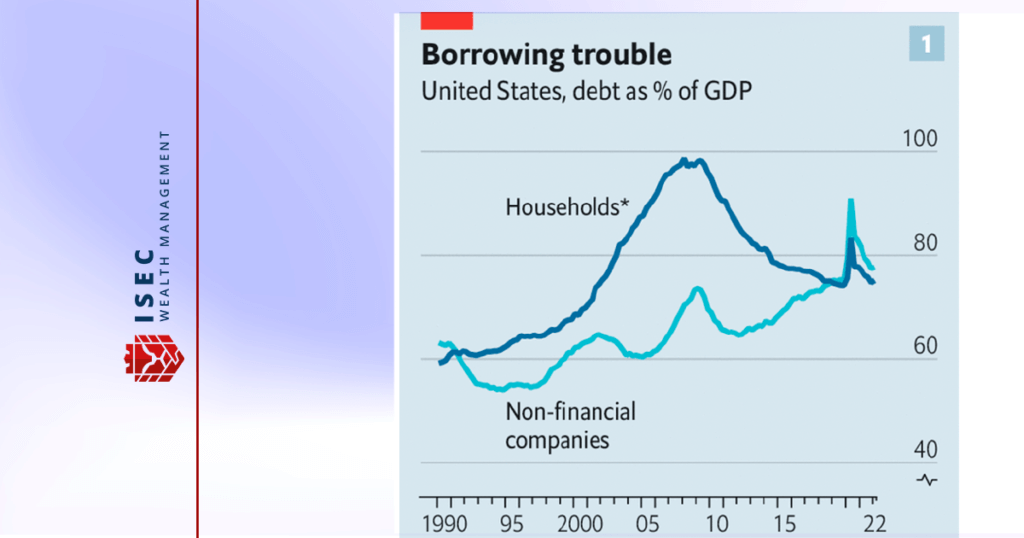

Another problem looming large is the level of credit financing. The corporate debt share of GDP touched almost 80% in 2020, which was the record for corporates. Fortunately, it did not beat the household record of 2008, when debt to GDP was 99%.

This data leads to the question of whether the companies are able to pay off such a pile of debt. Fortunately, the vast majority of 2020 debt, which accounts for 87%, was issued with fixed coupons when the rates were at minimal levels amid COVID-pandemic and stimulus. The average coupon of that bonds is about 3.6%. It looks positively for companies and, hopefully, for banks professionally managing their asset-liquidity liabilities.

Loans taken in 2020 are not expected to mature in 2023. Most of them will mature in 2029. The same period of maturity is applicable for high-yield bonds: highly-indebted companies have taken a chance to refinance their debt in 2020 under low rates.

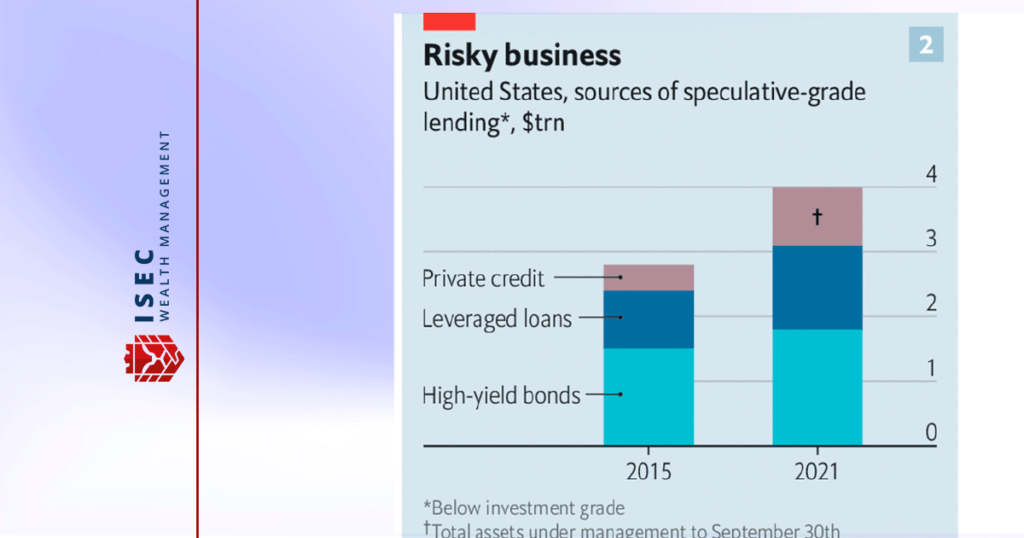

However, the concern is represented by companies with floating coupons to pay. These are typically presented in the syndicated-loan and private-debt markets.

The first concern is the companies’ financial burden of increased coupons due to be paid. The second even more serious concern is that the market of high-yield bonds has surged since 2015 by 15%, and the volume of leveraged loans, a risky subset of syndicated loans, burst by about 50%.

The only positive outlook on this ubiquitous corporate indebtedness is that it is not soon to come unless the companies start defaulting. However, the officials, banks and companies seem to control the situation.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

I am a fan of the ISEC WM analytics as I always learn something new. I do not use it to trade but it has become my source of economic news and forecast, such as the rising corporate debt fears.