With the tremendous economic impact of the COVID-19 pandemic, 2020 was an unprecedented year of stock price growth. This was a year of wild equities valuations: S&P 500 reached such a high price-earnings ratio that has not been observed over the past decade and has rarely been seen before. Equity valuations were supported by low interest rates, economic stimuli, increased retail investor activity and speculative behavior. Widening gaps between fundamentals and valuations and growing stock market capitalization-to-GDP ratio are strong warning indicators. Increasingly, experts are warning against a bubble. Is the stock market actually in a bubble? Should we expect a crash soon?

In his Nobel Lecture, Eugene F. Fama defines a bubble as “a large irrational price increase that involves a large predictable decrease.” Is it possible to know when rallies turn from logical to irrational and when a crash should be expected?

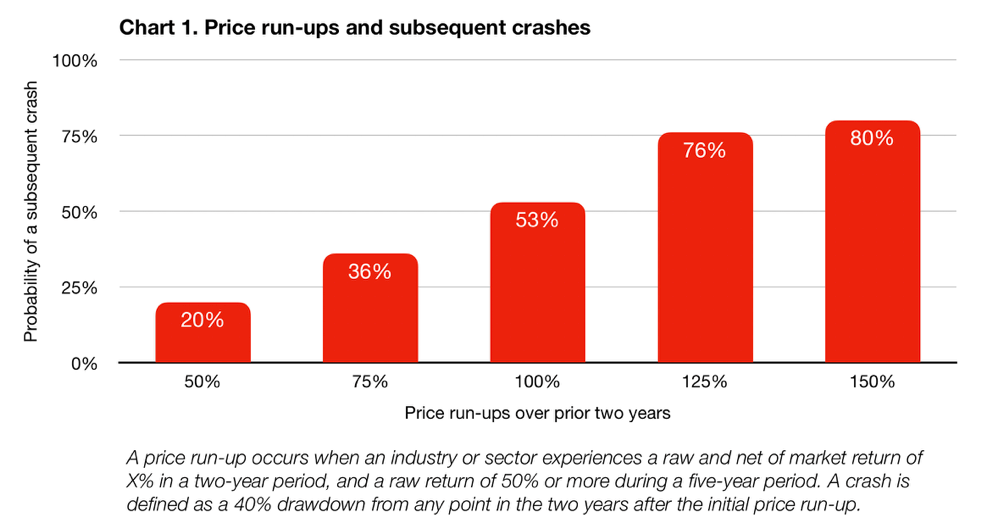

A study by Harvard University researchers published in 2019 analyses the predictability of a future crash from past industry returns. Not all bubbles crash. However, according to the study, sharp increases in stock prices in an industry predict an increased likelihood of a subsequent crash. The results for the US market are shown in Chart 1.

In the survey, bubbles are referred to as the episodes in which stock prices of an industry have increased over 100% in terms of both raw and net of market returns over the previous two years. According to the study, other factors also increase the probability of a crash:

- increase in volatility,

- disproportionate price rises among newer firms,

- especially rapid price increases

- stock issuance,

- lower book-to-market ratios and higher price-earnings ratios

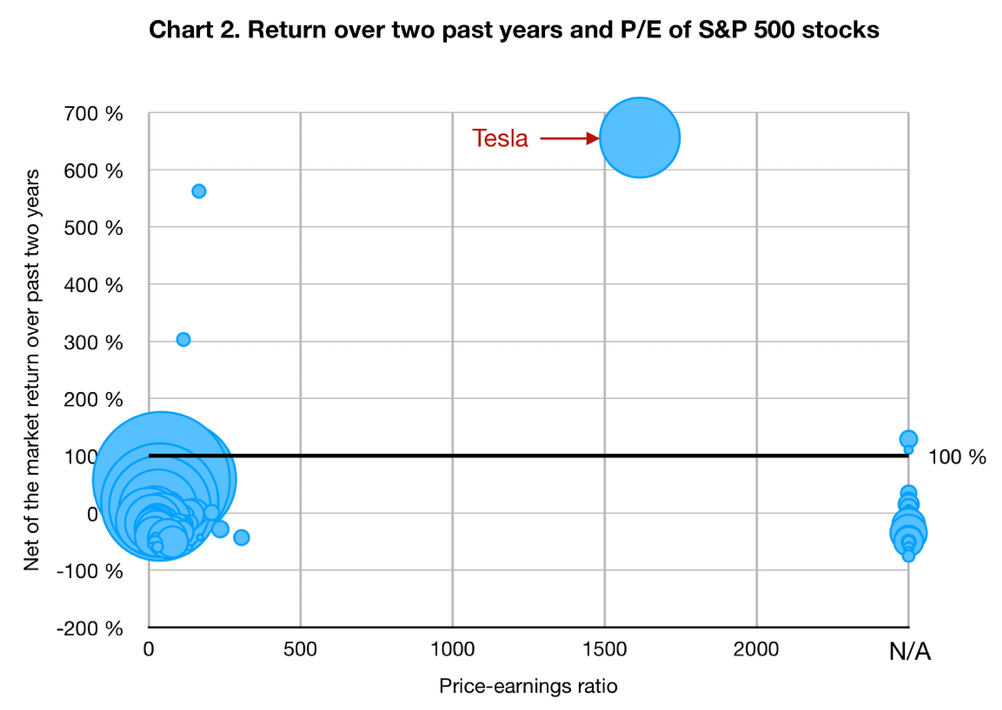

We have examined the performance of the S&P 500 per sector. Between the end of 2018 and the end of 2020, S&P 500 rose by 50%. IT sector recorded a 111% growth in the same time (the highest among the sectors), which means it didn’t meet the condition of an over 100% net of the market return. However, we have looked at the performance of the individual stocks over the past two years as well. The picture is more exciting here (see Chart 2).

Tesla is a remarkable example meeting the criteria to classify it as a bubble: it shows a dizzying price growth over the prior two years (the highest among the companies) and a crazy P/E ratio. Again, also here a crash is not certain, but the history offers clues, and the odds are strongly in favor of a correction.

There is one more important thing. Although a crash is almost certain for very high past returns, its timing is not. Although the factors mentioned above are good indicators of a higher probability of a crash, it doesn’t mean that they can help time the bubble. The authors stress out that “bubble peaks are extremely hard to call and therefore betting against bubbles […] is risky”. Therefore, investors shouldn’t try to time the market and guess whether it will fall or rise in the near term. Rather, they should avoid overreacting and stick to the strategy.

Our takeaways

Perhaps, zero interest rates can justify current broader market valuations, but there are certain assets that are in a bubble now. Thus, we should not be surprised if we see a correction. Anyway, good diversification and patience are the things that will help investors reduce risk and achieve their long-term return targets.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.