GameStop made headlines after a group of users in an online community rallied to increase the price of the company’s shares.

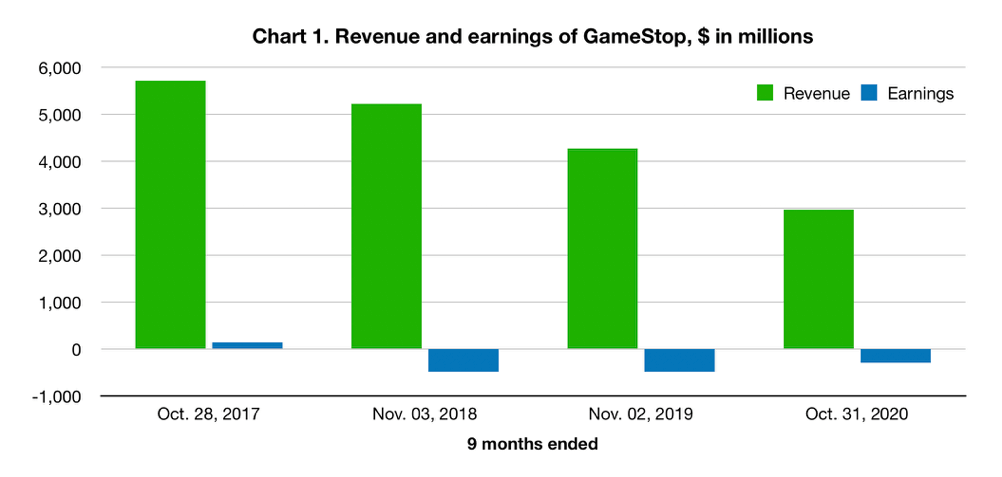

GameStop is an American video game retailer with over 5 thousand traditional retail stores in the United States, Canada, Australia, New Zealand and Europe. Its business has experienced difficulties in recent years as a result of competition from online services and the impact of the COVID-19 pandemic (Chart 1). As a consequence, the price of GameStop shares declined, leading many institutional investors to short sell the stocks.

A group of users in an online community on Reddit believed the company was undervalued. They also noted how heavily shorted the stock was. Therefore, they could trigger a short squeeze by driving up the price to the point where short sellers had to give in and cover their positions at significant losses.

Short selling is a practice in which an investor (short-seller) borrows shares and immediately sells them in the hope to buy them back later at a lower price, return the borrowed shares to the lender and profit off the difference. Short squeezing occurs when the shorted stock jumps in value. Short sellers are then forced to buy back the shares they had originally sold, in an effort to prevent their losses from going up.

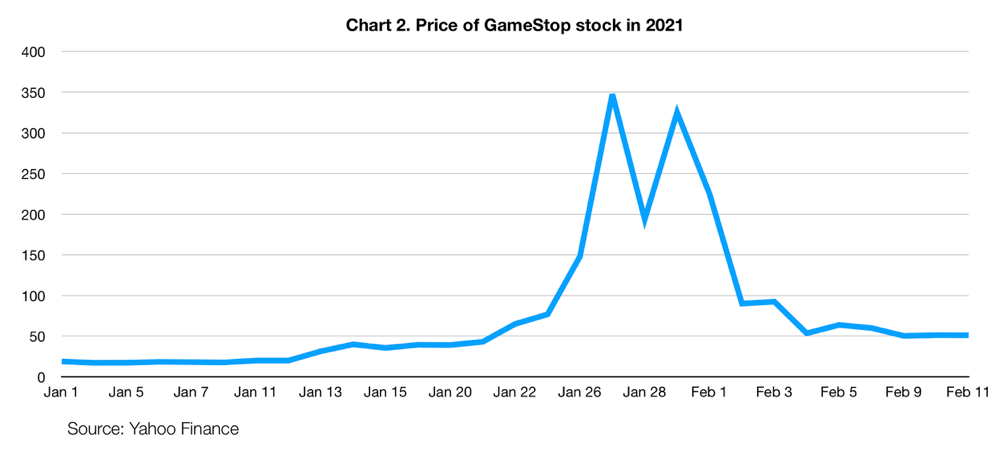

In January 2021, Reddit users built the basis for a short squeeze on GameStop, pushing up the stock price significantly. The sharp increase wasn’t justified by the fundamentals or improved prospects. It was rather what Peter Atwater, an economics lecturer at William & Mary, calls a “flash mob with money.” Chart 2 shows the price of GameStop in 2021.

The share reached $483 on January 28, which is 2,564% above the price at the beginning of the year. It fell sharply in February.

There are those who took advantage of the spike in share prices. Four directors of GameStop have benefited from the frenzy. CBS News reports that four members of GameStop’s board of directors have pocketed $20 million from selling company stock since the beginning of the year. Institutional investors have benefited as well: according to Reuters, some of Wall Street’s largest asset managers have realized gains both from their share stakes and from lending out stocks to short sellers. Brokerage firms, trading systems and market makers have also benefited from higher trading volumes.

As expected, short sellers suffered huge losses: Bloomberg reported that they lost a total of $6 billion due to the squeeze. But the retail investors have lost as well! Many of them bought the shares when they peaked in price or shortly thereafter. The Washington Post reports that some of them have lost a significant portion of their savings. Situations like this also hurt the entire stock market. As Alexander Kurov, a professor of finance at West Virginia University, wrote in a MarketWatch article, increased number of bubbles and their crashes could make it harder for companies to raise capital.

What do we learn from that? Highly speculative behavior and investing in securities at prices not justified by facts but driven by manipulative or psychological factors is a dangerous undertaking. When the price of a stock loses all connection with the fundamentals, a collapse is almost certain. GameStop demonstrated what happens when stock prices do not reflect reality. Retail investors have become a major power of the stock market. However, they should make informed decisions and take professional advice rather than follow thoughtless tweets.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.