Modern Portfolio Theory

Modern Portfolio Theory (MPT) revolutionized investment management by offering a powerful approach to investing that aims to maximize returns while effectively managing risk. Developed by Harry Markowitz, MPT uses mathematical models to construct portfolios that provide the highest expected return for a given level of risk or minimize the risk for a given level of return.

One of the key principles of MPT is diversification. By investing in a range of assets with low correlations, investors can reduce the overall risk of their portfolio without sacrificing returns. This strategy enables investors to mitigate and overcome declines in one market sector through the performance of another, thereby maintaining overall portfolio performance.

The Markowitz Model in Practice

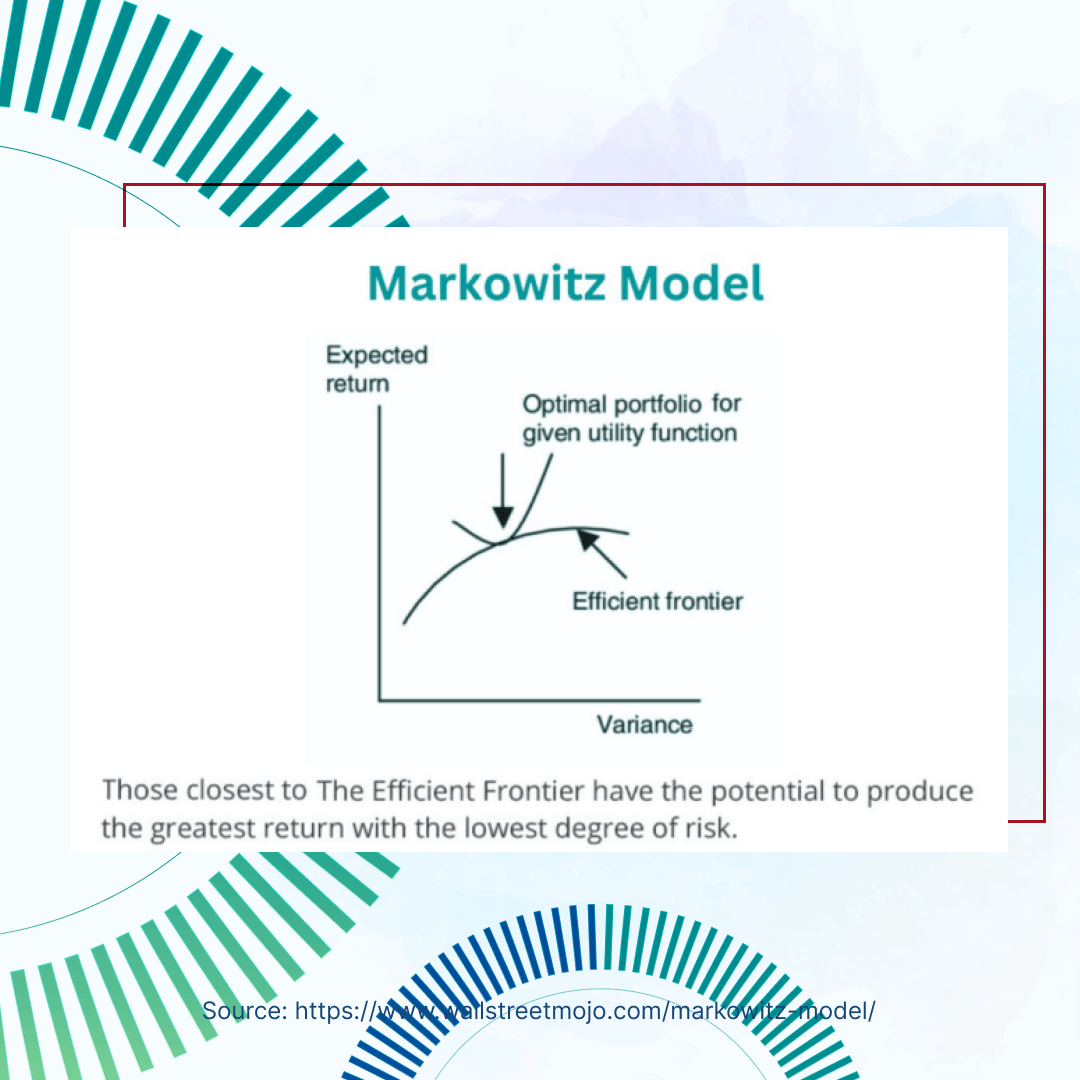

The Markowitz Model is a mathematical framework that enables investors to construct an optimal portfolio based on their risk tolerance and return expectations. By considering the expected returns, volatilities, and correlations of individual assets, investors can create a well-diversified portfolio. The model looks at the expected returns and volatilities of individual assets as well as the correlations between them to determine the best allocation of assets.

Markowitz’s concept of the efficient frontier further refines MPT by identifying portfolios that offer a maximum return for a given level of risk or a minimum risk for a given level of return. Portfolios located on the efficient frontier are considered efficient portfolios because they provide the best risk-return trade-off.

In conclusion, Modern Portfolio Theory and the Markowitz Model offer investors a systematic approach to portfolio construction. The Markowitz Model has specifically assisted investors in optimizing their portfolios for maximum returns at a specific level of risk. Overall, MPT and the Markowitz Model remain relevant tools in modern portfolio management, assisting investors in achieving their financial goals while effectively managing risk.

Source: wallstreetmojo.com

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

Not gonna lie, I don’t understand this at all 😭😭

Good thing that I don’t have to. Really like that isec wealth management takes care of this investment side for me, so I can focus on actually living my life. If I took years to understand “The Markowitz Model”, I would be doing my life a disservice 😭

Proper investments should be done by professionals, imo.

I didn`t understand a thing😅 but it seems that isec wm knows what to do with money and investments.

This model is appeared to be something sophisticated and practical to apply🤔 Isec Wm does a very good job, proving the explanations what methods they use, instead of blindly investing the funds💪

Great read… it’s nice to see that isec wm reviews its investment models and methods 👍

to be honest Im not sure abotu this model too, seems complex. All I need is for you to keep my money safe, and preferably beat s&p, or dow jones. Which so far its doing.

TBH its probably not THAT hard to do in 2025, with Trump currently tanking everything, but some how my porfolio in Isec wealth management is staying strong, almost no losses, even gains in march and febuary…

I see how you are making my investments grow so much. Nice ideas, havent heard about it at all.

How do you apply it to my portfolio, by the way? In choosing stocks over bonds, or vise versa?

I appreciate how they handle their client portfolio which makes it very profitable. They diversify the capital received and use it to get different aSSets that can balance out the aCCount. This firm is runned by experts and they are very reliable.

You see, this is why I don’t invest on my own SMH. I’m glad to let someone else think about all of these models instead so I can just forget about it and look at the numbers going up. ISEC wm review the data quite frequently, so I always get updates on what’s happening