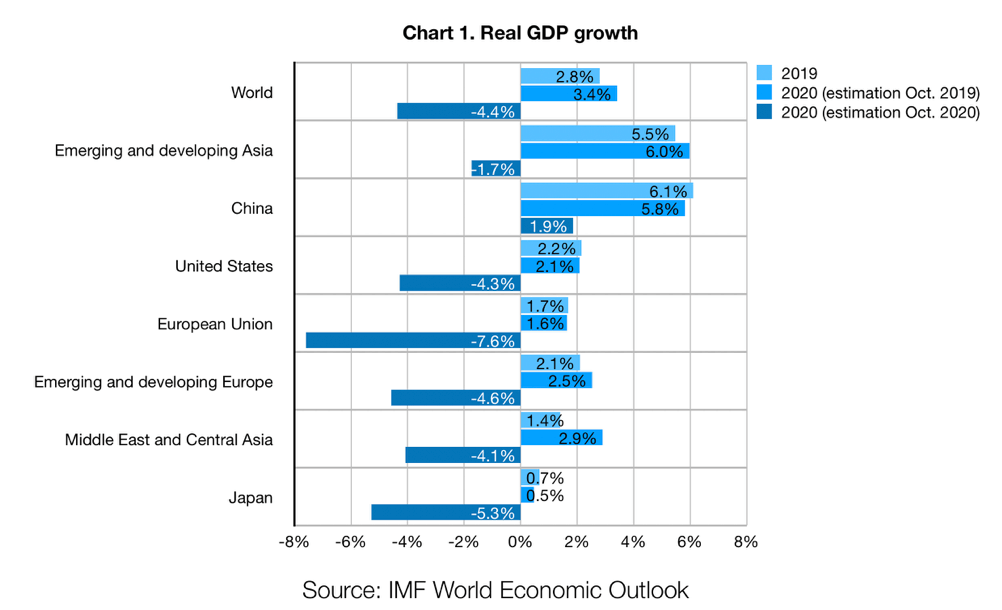

According to the IMF World Economic Outlook, following 2.8% growth in 2019, global GDP is expected to fall by 4.4% in 2020. This makes the COVID-19 pandemic the most serious economic crisis in post-World War II history. How are these affecting countries and stock prices? Which ones are the biggest losers? Are there any winners?

Economies

This race isn’t about winning, it’s about losing less. In October 2019, before the outbreak of the pandemic, the IMF was expecting the world economy to grow by 3.4% in 2020. In October 2020, with the second wave already underway, the forecast for 2020 is -4.4%. Every country of the world has faced a decline in the GDP growth forecast for 2020. Chart 1 shows some of the figures.

Asian countries are successfully controlling the spread of the pandemic and are better positioned than the EU or the United States. China will be the only one of the top 20 economies to continue growing in 2020. By the way, Sweden, a country which is famous for relatively easy pandemic related restrictions, is less economically affected by the pandemic: with expected 4.7% GDP decline, the country’s economy is in a better position than EU average (7.6% GDP drop).

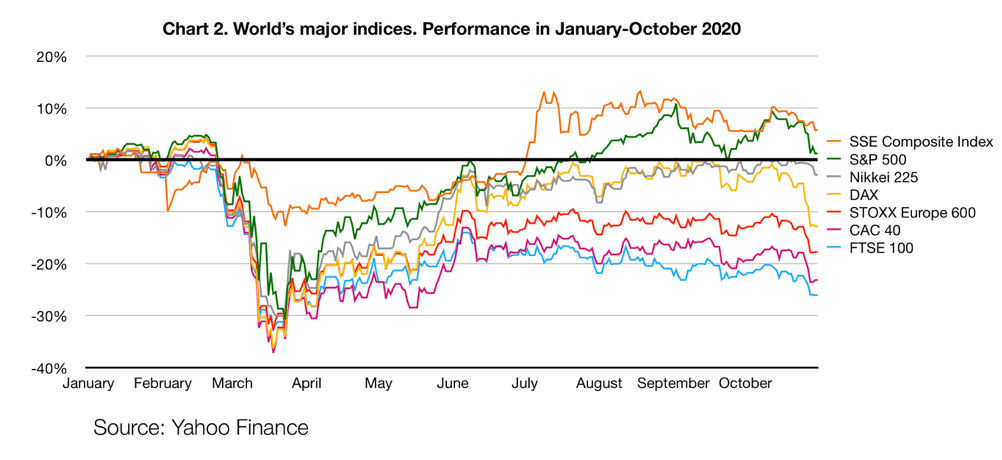

As Chart 2 shows, the world’s major stock market indices reflect the above situation.

Most affected stocks

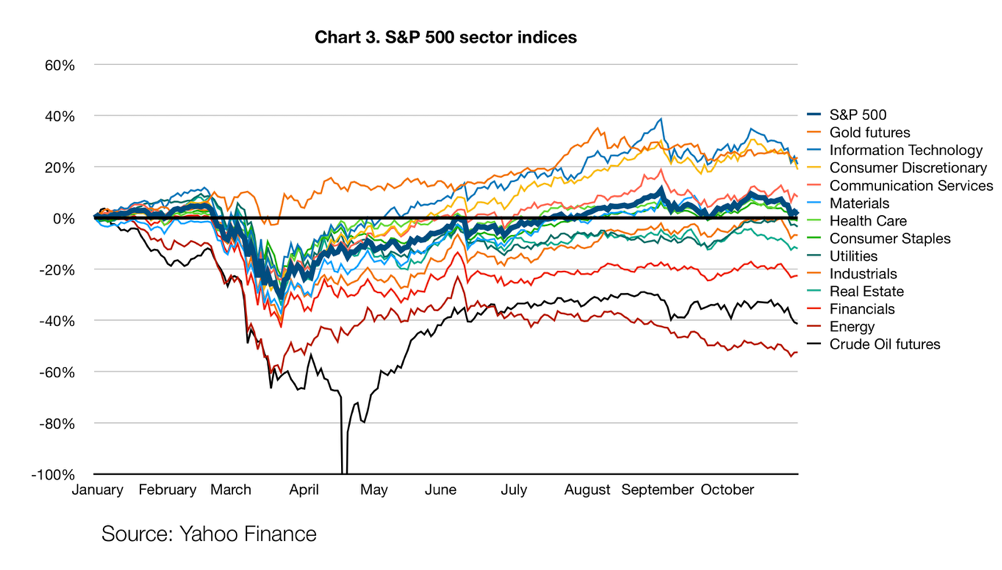

Oil and related industries are among the true losers. The crude future price was even negative on April 20th! The oil price decline in times of sharply falling demand is not a big surprise, though. The dramatic decline in the energy sector’s value is directly linked to developments in oil prices. Banks have been affected by probable credit defaults and in addition by zero interest rate policies (this is an old and ongoing challenge). Also, the insurance industry has lost a good deal in its value as the impact of pandemic-related claims is expected.

The real estate sector has taken a serious hit as well. The companies engaged in the acquisition, development, ownership, leasing, management, and operation of hotel, retail, office, residential and health care properties have lost significant portions of their values. Airlines, aerospace manufacturers, hotels, resorts, and cruise lines have lost much of their market capitalization as a result of the closure of borders and travel restrictions. It is interesting to see that the stocks of major restaurant chains are actually not among the biggest losers.

Stocks gaining value

However, there are also industries that have been very successful during this period. As the entire world has gone online, the companies in IT and communication services sectors as well as internet retail have been the absolute winners in the COVID crisis. As people stayed in their homes, there was a growing demand for delivery services and home improvement products. Transport, courier, and logistics providers have been also clear winners in this situation. Home improvement retail has been successful, too.

Health care equipment manufacturers and drug discovery companies have also added value. Gold, which is a traditional safe haven in times of uncertainty, had remarkable growth. You can see the YTD stock price performance per sector on Chart 3. The graph presents US stocks, the global picture is very similar.

Our takeaways

The COVID-19 pandemic has undoubtedly caused a very serious global economic crisis that impacts a wide range of industries and businesses. Nevertheless, even with this kind of a crisis, there are companies and whole industries with great performance. Moreover, as many stocks are rather cheap now, it may be a great time to start investing.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.