Investors place their money according to a broad set of criteria, with financial performance (expected return) and risk being the most important; other factors have historically included political and macroeconomic considerations. Increasingly, ESG (which stands for environmental, social, and governance) has become an important factor when deciding where to invest.

ESG investing is sometimes referred to as sustainable investing, socially responsible investing, impact investing, green investing. ESG fund managers consider environmental, social, and/or governance factors to analyse and select securities that meet certain criteria. Here are some factors for each category:

- Environmental: energy consumption, pollution production, biodiversity, waste management, water management, risks and opportunities associated with the impacts of climate change on business

- Social: diversity and inclusion, human rights, the health and safety of employees, consumer protection, animal welfare, or whether the company invests in its community, as well as how such issues are addressed by other companies in a supply chain

- Governance: transparency and reporting, ethics, compliance, shareholder rights, management structure, executive compensation, employee compensation

ESG strategies include:

- selecting businesses according to one or more ESG factors,

- exclusion of certain sectors or companies based on ESG criteria

- focus on companies that have room to improve on ESG issues in order to support the progress

- integration of ESG criteria alongside other factors

It is important to understand what you are investing in and make sure the investment is consistent with your objectives, risk tolerance and preferences. This is particularly true for ESG investing as there are no common standards or definitions with respect to the ESG factors. Different ESG asset managers may use subjective criteria, different definitions, weight ESG factors differently or focus on different specific criteria within a factor.

Investors can incorporate ESG criteria to improve performance, manage investment risks, make sure that the investment matches their values, support ESG-related issues. For example, by following ESG strategies investors may be able to screen out companies whose practices could signal a risk factor (remember Volkswagen and Dieselgate (https://en.wikipedia.org/wiki/Volkswagen_emissions_scandal)) and avoid associated losses.

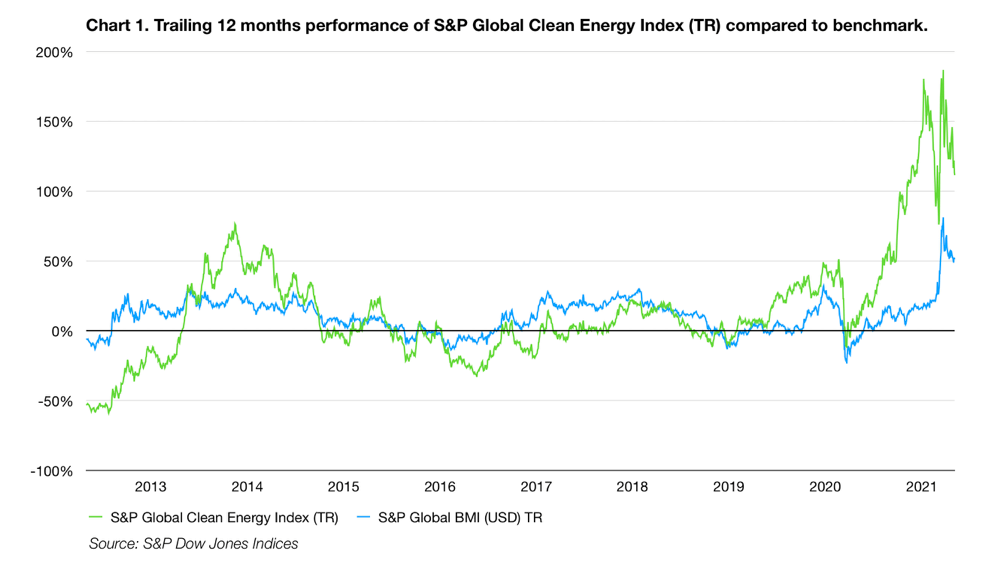

However, ESG investments may also be more risky than portfolios without ESG parameters. Securities may be included or excluded based on ESG factors rather than the fundamentals, which may limit diversification (and thus increase the risk) and significantly influence the performance. Chart 1 shows an example: we looked at the changes of the S&P Global Clean Energy Index (Total Return) compared to its benchmark (S&P Global BMI (USD) TR).

Although the S&P Global clean Energy Index has outperformed the S&P Global BMI (Broad Market Index), we all know that past performance does not reflect future performance. As the ESG industry matures, the factors should be more homogeneous and clearer for investors to assess and be able to base their investment decisions on. Only then can investors assess the true performance of ESG investing relative to the broad market index.

ESG investing is likely here to stay, however, there is a need to develop homogeneity across the definitions of ESG factors as well as the disclosure requirements for companies to disclose the data in an informative and representative manner. Once this harmonization is achieved, corporate and investor interests should be more aligned when it comes to ESG investing.

Disclaimer Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

I think that this kind of investment makes sense especially nowadays. Now the world is striving for a greener improvement of the planet and green investments are needed more than ever and refunds will be good too. This is the future and it must be understood.

I am interested in many things from the world of investments and I read your blog with great pleasure and gain new knowledge.

My next step is the ISEC WM deposit. I really want to finally have my own investment portfolio and receive some income.

As far as I know in our time, this company provides some of the best conditions for novice investors without a lot of capital.

This is great, I think.

last year ended very well and I’m glad I agreed to try a bit more agressive strategy. first was thinking of a conservative approach.