The Federal Open Market Committee (FOMC) kept interest rates close to zero and maintained its asset purchase program. Market participants are still trying to determine when rates will be hiked and when the asset purchase program will be tapered. Fed Chair Jerome Powell has stated on numerous occasions that rates will remain as they are until “labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time”. In addition, the Federal Reserve will continue to purchase at least $80 billion Treasury securities and $40 billion agency mortgage-backed securities per month until the aforementioned targets are met.

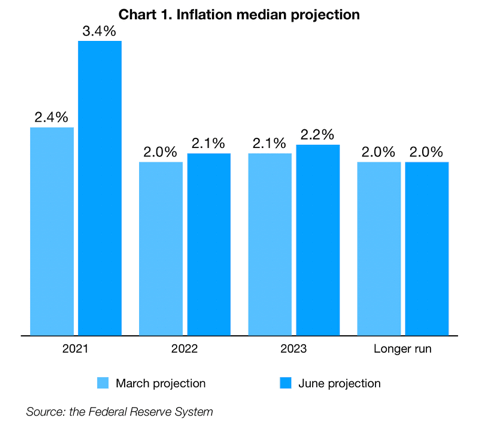

The Fed’s 2021 inflation June projection (3.4%) jumped sharply from the March estimate (2.4%), but it still expects it to be transitory and stabilize around the 2% mark from 2022 and beyond (see Chart 1).

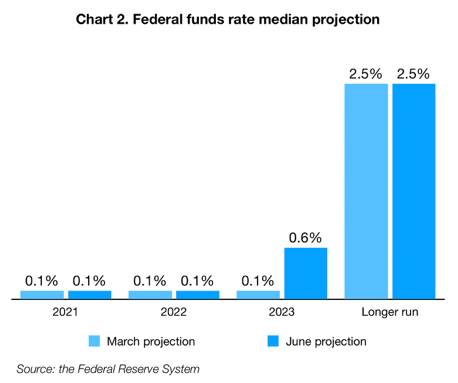

As economic conditions continue to strengthen, some Fed governors have indicated that a rate hike may come sooner than is currently expected which should cool off some inflation fears; previously Jerome Powell had indicated that rates wouldn’t be hiked until 2024, but the recent economic activity pick up, the recovery in the job markets, increased price levels and increased saving level have forced some governors to pull forward a rate hike (see Chart 2).

The impact of inflation on fixed income has been evident throughout history: as inflation picks up, fixed income investors tend to require higher rates to induce investments. Since fixed income investors receive coupons, those coupons lose purchasing power as inflation increases. Remember that higher rates imply lower prices.

The dynamics of the stock market means that inflation impacts sectors differently. Higher inflation can mean that companies can increase prices, but their expenses may also increase. Commodity prices, wages, office space are some of the expenses that tend to increase, though given the backdrop of the pandemic, mostly commodity prices have increased significantly. Higher prices can lead to either higher or lower revenues depending on the pricing power of companies and the price elasticity of their products. On the other hand, higher inflation can lead to the Fed hiking rates sooner, which could be bad for long duration equities: these are stocks whose value is highly dependent on cash flows way out in the future (higher interest rate means a higher discount rate which lowers the present value of those cash flows).

The main worry for some market participants is the fact that the Fed may leave it too late prior to hiking rates and be forced to hike rates substantially, which could potentially lead to a recession. As markets are a forward looking, discounting mechanism, the current path of interest rates as described by the Fed policy appears to sit well with investors, however downside risks still remain. We do expect inflation to be transitory, as some factors such as commodity prices have already seen a slowdown in momentum and cannot stay sustainably high as demand falls at higher prices. On the other hand, items like wages tend to be stickier and more permanent. Overall, we are optimistic on the growth of the US economy, given the significant fiscal and monetary stimulus.

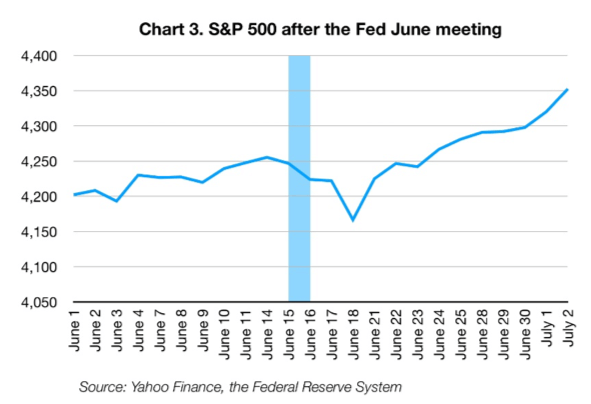

Typically, in an inflationary environment, it makes sense to buy physical assets such as commodities (or commodity miners i.e. the materials sector) and real estate, or short fixed income securities (since rates should go up in an inflationary environment and prices lower). Commodities and real estate have been on a significant winning streak year-to-date, while materials have lagged over the past couple of months. On the other hand, 10-year Treasury yields have actually dropped, unexpectedly, signalling that bond investors expect inflation to be transitory. Overall, the message from the markets is that there is significant uncertainty baked in inflation expectations as market participants as a whole cannot yet determine whether inflation will indeed stay elevated or not and whether it will be transitory or permanent. On a side note, since the last Fed meeting in June, the S&P500 has hit an all time high almost every single day and continues to do so.

The bottom line

With inflation in the US expected to be only temporary and the US economy recovering rapidly from the COVID-19 pandemic, the stock market remains bullish. An unexpected stickiness in inflation and the Fed increasing rates and tapering its asset purchases sooner than anticipated may affect the stock market. However, we are quite optimistic about the economic backdrop, as projections for real GDP growth in 2021 continue to stay strong (close to 7.0%) and economic activity continues to strengthen.

Disclaimer Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.