The increase in numbers of liquid alternative mutual funds has provoked additional interest in their returns, risk, and diversification strategy compared to hedge funds.

Liquid alternative mutual funds employ market neutral, equity long-short, managed futures, and multi-alternative, which are aimed at risk limiting, unlike hedge funds with a greater appetite for risk. The abovementioned strategies give alpha of about 1.38%, 1.49%, 1.54% and 1.80%, respectively. In contrast, hedge fund alpha is 1-2% higher.

In terms of risks, liquid alternative mutual funds have a lower beta, a measure of risk, of about 0.31-0.36, compared to 0.43-0.49 for hedge funds. This is due to leverage constraints on mutual funds.

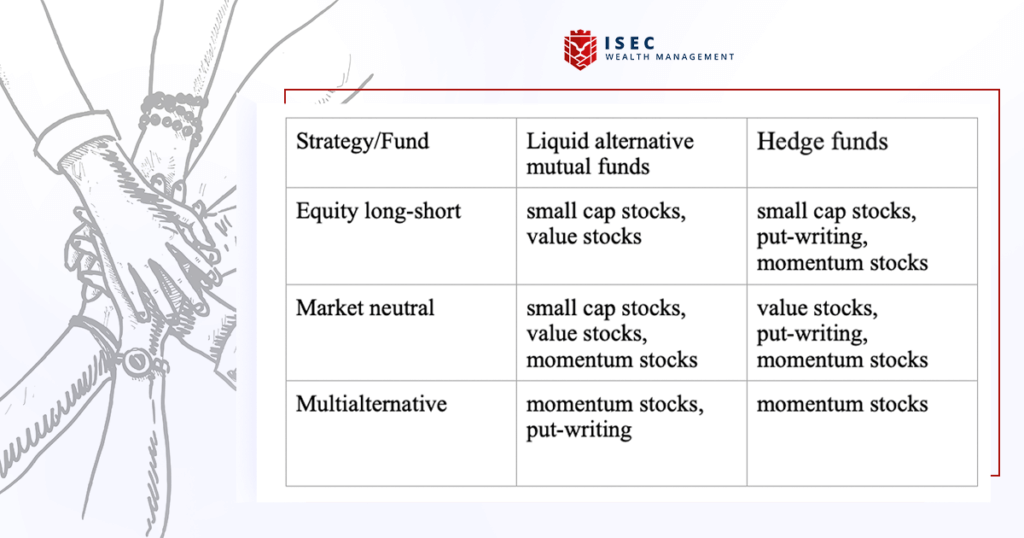

When it comes to strategies, funds prefer different strategies. A more detailed overview of strategies is in the table.

Both liquid alternative mutual funds and hedge funds seem to have proper downside protection. This is especially true looking back to the financial crisis. Liquid alternative mutual funds are especially perfect fit in terms of risk limitation as they are regulated by the SEC in using leverage and derivatives.

The strategy is complicated as it was admitted by many experts and needs substantial time to understand it well and determine whether it is suitable.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.