Defined-results ETFs or buffered ETFs are created for those who are worried about a bearish market and do not mind limiting gains in return for reducing losses. The nature of buffered ETFs is similar to structured notes linked to underlying securities. Such ETFs include call and put options to limit downside risks. Such ETFs are similar in their characteristics but with a feature of setting loss protection at a certain level of 10%, 15% or 30%. The presence of options makes this structure pretty expensive.

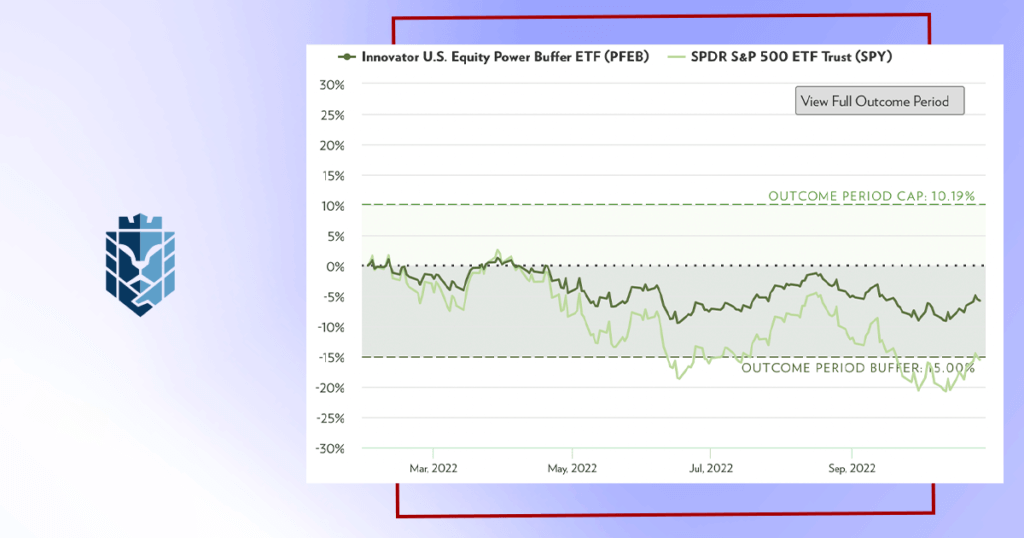

An example of buffered ETFs can be Innovator US Equity Power Buffer ETF, which lost almost 3 times less compared to SPDR S&P 500 ETF.

The number of buffered ETFs is not very large, but 149 ETFs of such class are present on the market. They are linked to the performance not only of the S&P 500 but other indexes like the NASDAQ 100 and the MSCI EAFE as well.

The buffered ETFs are monthly issued with no expiration within 12 months but with the reset to the underlying.

Still needed to mention the underperformance of defined-results ETFs as the flip side. In a bullish market, buffered ETFs are subject to unreceived (capped) gains.

The strategy is complicated as it was admitted by many experts and needs substantial time to understand it well and determine whether it is suitable.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.

It’s quite an interesting note about ETFs. I had no idea that it may be a good instrument for reducing risks. However, everything has its price, thus people should sacrifice profits.

Anyways, people have to diversify portfolio adding assets with high, moderate and low risks.