Zero rate policies, boredom during lockdowns, FOMO (fear of missing out), economic stimuli are the things that affect the behavior of individual investors in recent times. Perhaps we need to add a lack of common sense to the list. All these things are the reasons for the recent frenzies like investing in bubble stocks, purchasing “meme” stocks, rise of SPACs, buying quasi assets such as cryptocurrencies. One of the latest phenomena is an NFT mania.

NFT stands for non-fungible token. This is a file, its unique identity and ownership are validated on a blockchain. NFTs are not mutually interchangeable, i.e. not fungible. NFTs are generally created by uploading files, such as digital art, to an auction market and can be purchased and resold.

NFTs can be used to transform digital creations, such as digital art, video game items, and music files, into objects of trade. However, the purchaser of the token is not granted exclusive access to the work or possession of the “original” digital file. NFTs can be considered collectibles such as autographed items or trading cards.

NFTs made the headlines last week when Christie’s sold a digital art work by an artist known as Beeple for $69.3 million after the bids started at only $100. This is the highest known price paid for an NFT at the moment and the third highest price in the list of most expensive artworks by living artists. Here are the most expensive NFTs sold so far. Much of this list includes CryptoPunks. CryptoPunks are 24×24 pixel (the resolution which is considerably smaller than the icons on your smartphone) art pictures, created algorithmically. Each of them has been generated by computer code and therefore no two characters are exactly the same, but some traits are rarer than others. The prices of the top deals are quite impressive: two of them have been sold for more than 7 million dollars each. You can see the top CryptoPunk sales here.

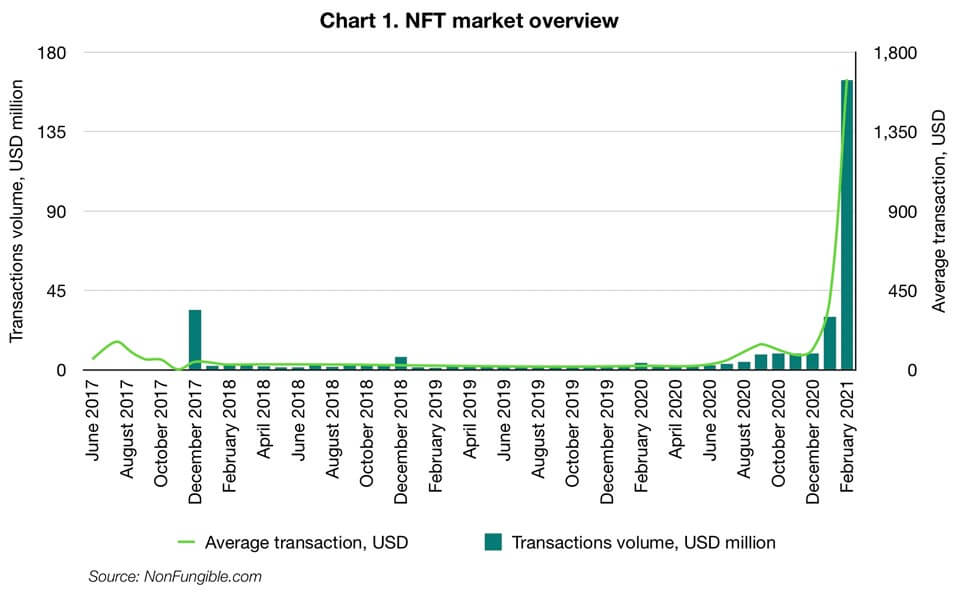

NFT mania gains pace. The volume of transactions tracked by NonFungible.com as well as average transaction have skyrocketed (see Chart 1).

Some people use NFTs as a form of investment. Well, an NFT can have some value to the individual who buys it. The value can be historical, cultural, emotional and so on. But we don’t think they have any value as an investment. Seth Klarman, an American billionaire investor, hedge fund manager, and author, wrote in the preface to Security Analysis, “In recent years, some people have attempted to expand the definition of an investment to include any asset that has recently — or might soon — appreciate in price: art, rare stamps, or a wine collection. Because these items have no ascertainable fundamental value, generate no present or future cash flow, and depend for their value entirely on buyer whim, they clearly constitute speculations rather than investments.” The same perfectly applies to NFTs. Actually, not only to NFTs, but also to trading cards, sneakers, and any other frenzy of this kind that may emerge.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.