On 8 February Tesla disclosed that it had updated its investment policy and had put $1.5 billion in bitcoin under this policy. In addition, Tesla is going to begin accepting bitcoin as a form of payment. This gave a serious boost to the cryptocurrency. However, the question is whether this move will be as good for the company as it has been for bitcoin.

Elon Musk explained the move by the negative real interest on fiat currency and by the need to look for interest elsewhere. Well, he is right, zero or even negative interest rate policies of central banks have limited the attractiveness of cash as an investment asset. It encourages investors to seek profit and sacrifice safety. However, buying cryptocurrency is an extreme move in the direction of sacrificing security. In addition, a company like Tesla is supposed to use the capital for growing business, but it puts it in a purely speculative asset. So the question is whether this action may be seen as safeguarding shareholders’ interests.

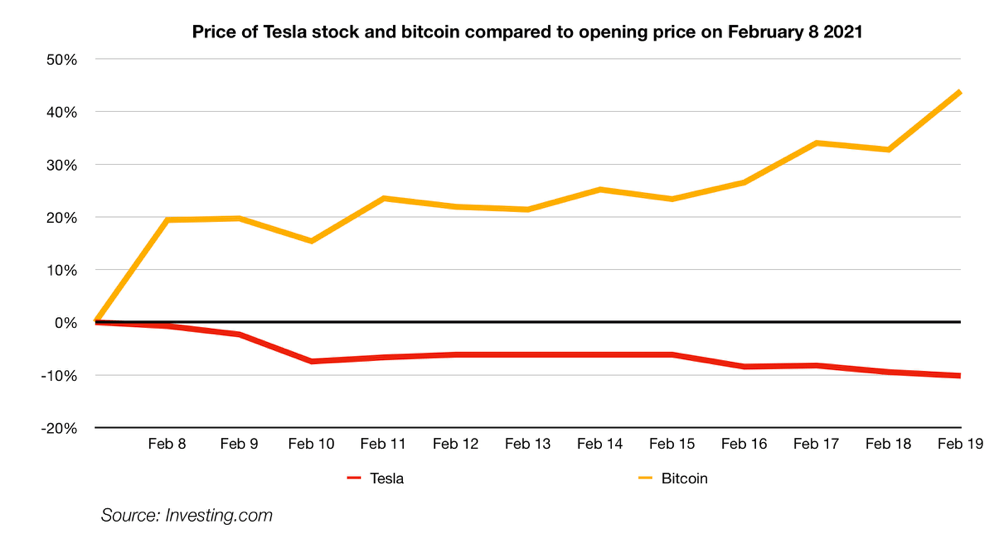

It seems that the shareholders of Tesla are not happy to be exposed to such a risky and purely speculative asset (if we may call bitcoin an asset at all). Chart 1 shows the development of the Tesla stock price and the bitcoin price after the disclosure.

Over the past two weeks, bitcoin is up 44%, while Tesla is down 10%. According to Reuters’ analysis, some investors are concerned that the riskier investment strategy may add volatility to the Tesla stock and make it even riskier.

More companies may follow Tesla. For example, Twitter is considering adding bitcoin to its balance sheet. Cryptocurrency fans praised Tesla’s decision to buy bitcoin and expressed their confidence that this would give rise to further adoption by corporations. However, a Gartner survey indicates that most finance executives are not planning to hold bitcoin as a corporate asset. According to the survey, 5% of respondents indicated they would begin to hold bitcoin in 2021, 1% said they would hold it at some point in 2022-2023, and 9% said it would be 2024 or later. That means 16% of the polled finance executives consider the idea of adopting cryptocurrency as a corporate investment. However, as Gartner puts it, they appear in no rush. Cryptocurrency’s notorious volatility is by far their biggest concern. Among others, the obstacles to holding bitcoin are slow adoption as an accepted form of payment, regulatory concerns, cyber risks, complex accounting treatment.

Our takeaways

- $1.5 billion in bitcoin is a manageable amount for Tesla’s balance sheet. A bitcoin crash wouldn’t ruin the company. However, this “investment” may add volatility to the already risky Tesla stock.

- As there are certain serious obstacles to holding bitcoin as a corporate asset, no quick adoption by corporations should be expected.

- The move appears to be better for the bitcoin than for Tesla.

- In our opinion, there are lots of good investments with fair returns which are far less adventurous than putting money in cryptocurrency.

Risk Warning: The information in this article is presented for general information and shall be treated as a marketing communication only. This analysis is not a recommendation to sell or buy any instrument. Investing in financial instruments involves a high degree of risk and may not be suitable for all investors. Trading in financial instruments can result in both an increase and a decrease in capital. Please refer to our Risk Disclosure available on our web site for further information.